Decentralized exchanges (DEXs) have been looking for liquidity solutions for years. Komodo is innovating once again and presenting another unique solution — a user-friendly liquidity multiplier that Grandma can use. We took the idea of One-Cancels-the-Other order (OCO) trading styles and merged it with our atomic swap trading process on AtomicDEX. Now limit orders can be placed against any number of pairs at any number of price levels.

Moving into the initial beta release of AtomicDEX on October 29, the Komodo developer team has had one major goal in mind with polishing and refinement - Grandma-proof everything. With this in consideration, we have implemented an answer to one of the most difficult hurdles that DEXs face - low liquidity.

The Problem

Swap pool DEXs, like Uniswap, have come up with a solution for attracting liquidity providers in order to overcome the chronic DEX issue of low volume. The pools they generate though are host to a wide range of critical issues. Rugpulls, vampire attacks, and “impermanent loss” due to the bonding curve all create high-risk citations for those participating in these automated market maker pools.

The Solution

While automated market maker pools like Uniswap plus others continue to refine their tech and evolve, Komodo’s AtomicDEX has put forth a solution to create massive amounts of liquidity potential for each liquidity provider or market maker that joins the order books.

Oh, that’s right! We have decentralized order books. No more curves deciding the order size you get stuck with, or unaudited smart contracts controlling the code behind it. Users get complete control of the trades they place and pick straight from the order book for the trades they want.

So how does it work and how do we fill these order books?

Well, with a little help from the new Liquidity Pool Multiplier process, it works like this:

- Granny places an order using 1 BTC, trading against whatever coin she wants to get.

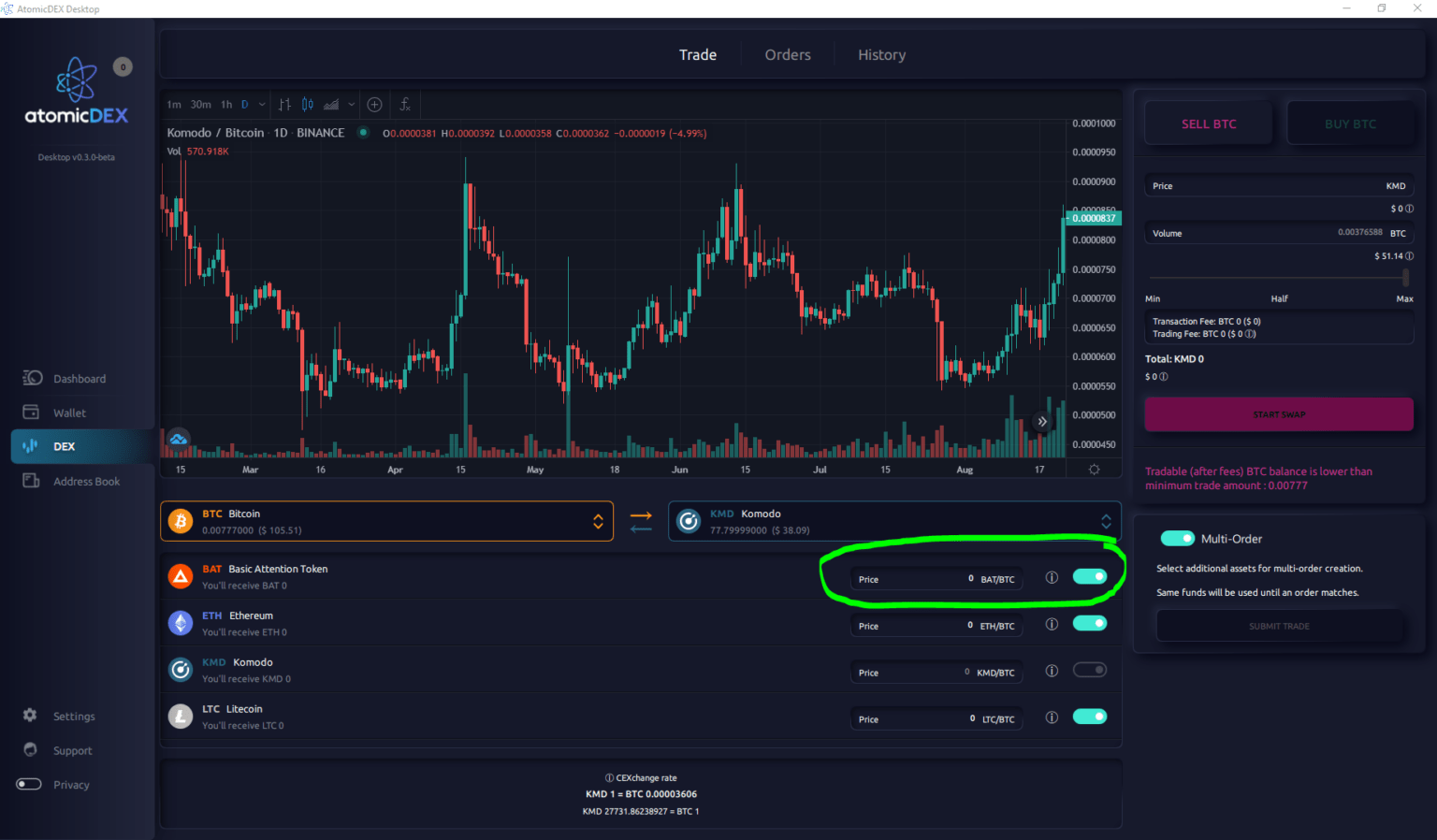

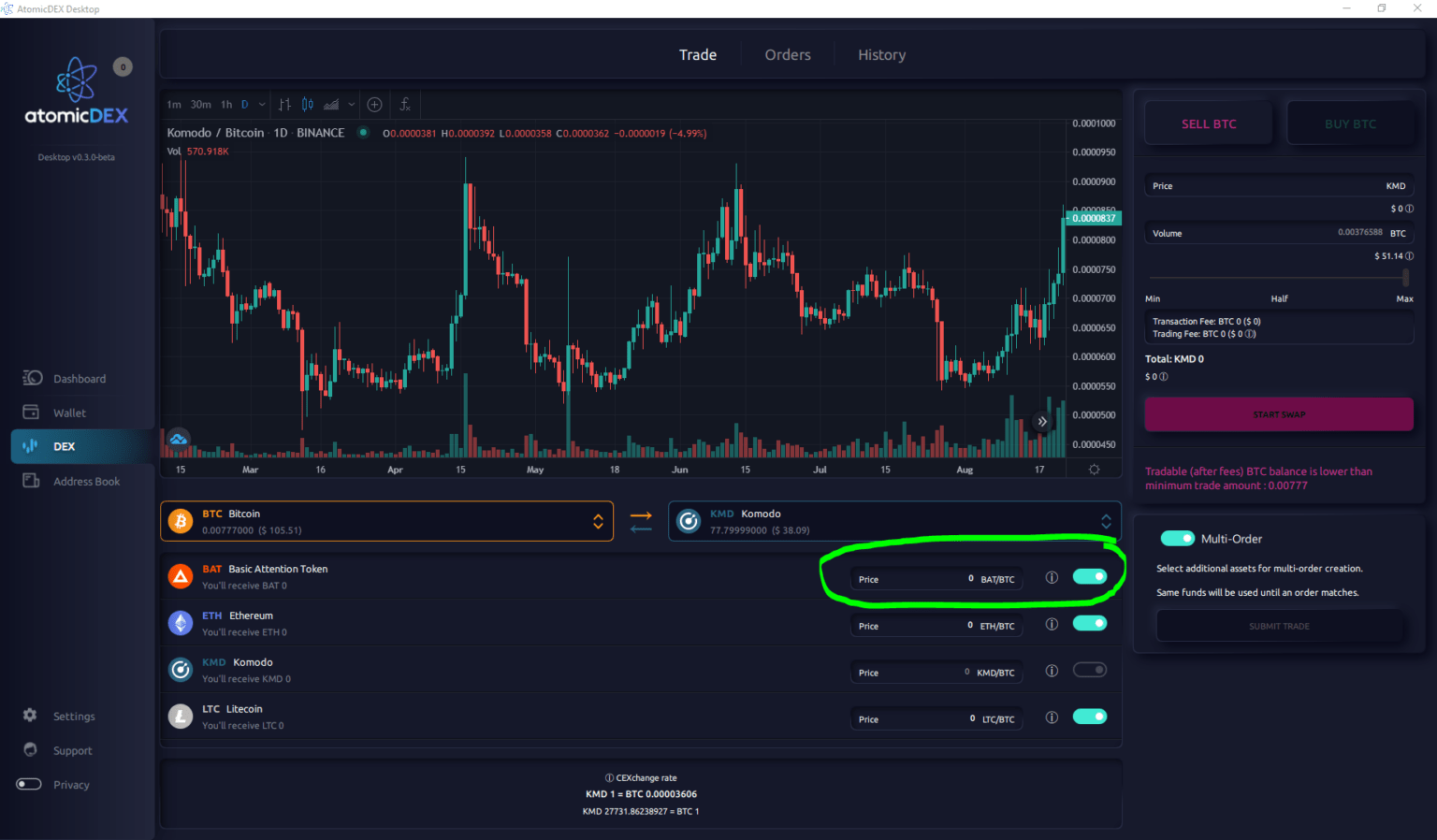

2. Then if Granny wants to trade that same 1 BTC against additional pairings, she can activate the Multi-Order switch to turn on the Liquidity Pool Multiplier function in AtomicDEX.

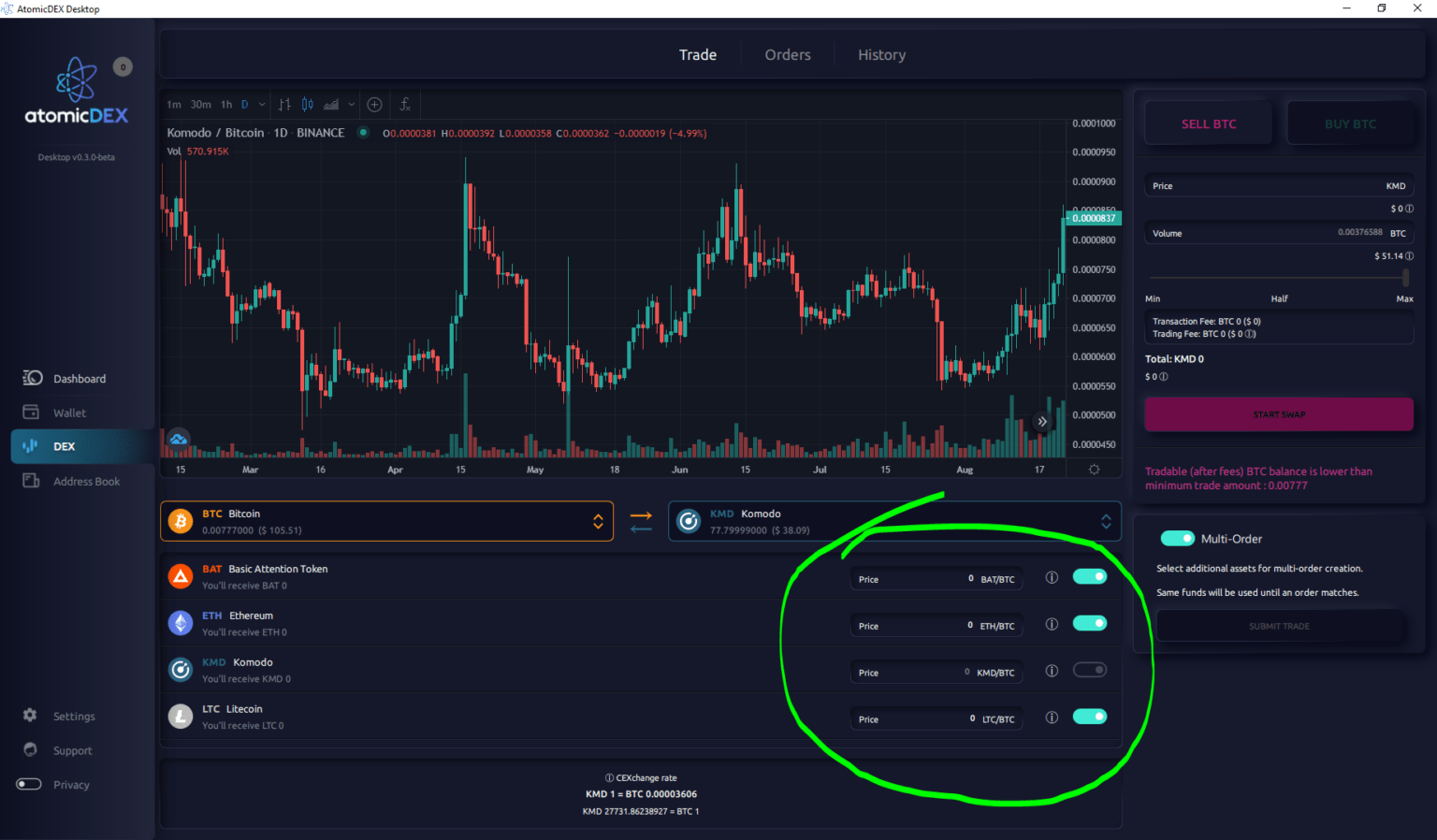

3. Granny then toggles on the coin(s) she wants to trade against in addition to the coin she set in step 1. The order sizes for those selected trading pairs are automatically generated, and everything is ready to go.

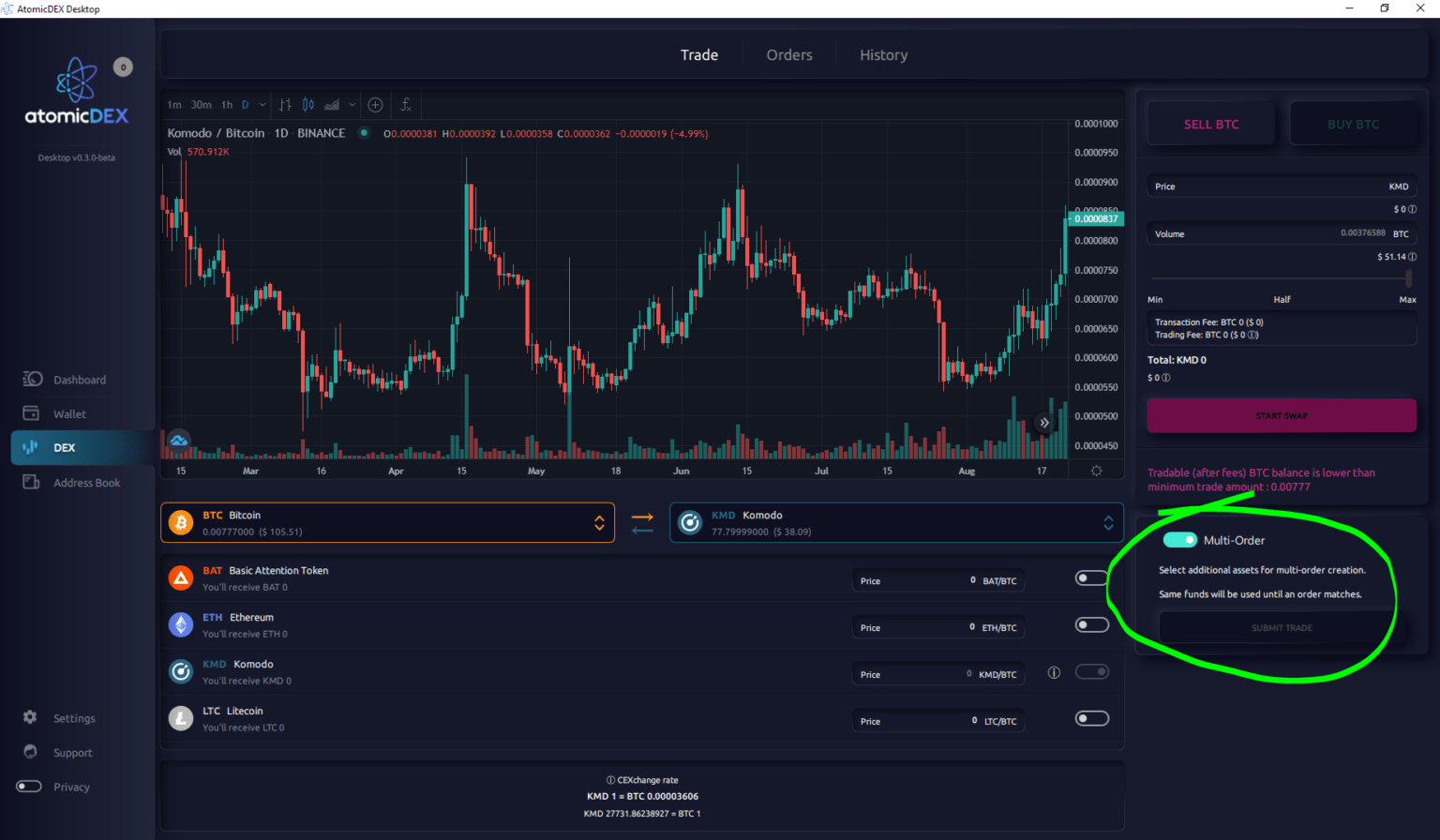

4. Granny approves or adjusts the auto-generated price swap targets for her additional orders then places the Multi-Trade by clicking the “Submit Trade” button.

5. At this point, if Granny picked 5 other coins to set orders against, then her 1 BTC is providing liquidity for 5 times its value! She’s effectively trading with 5 BTC as a Liquidity Provider or Market Maker.

The rest is handled by the protocol. When orders match, the original funds (BTC in this case) are reduced for every order that takes a buy out of it, until it’s gone.

Download the Latest Version of AtomicDEX

The OCO Liquidity Multiplier feature is available on AtomicDEX v0.3 (initial beta), which drops on October 29th. Trade with your Grandma, download the latest AtomicDEX version here.

Learn More About Komodo

https://github.com/KomodoPlatform

https://discord.com/invite/dsEMe2p

https://twitter.com/komodoplatform

https://www.reddit.com/r/komodoplatform/