Things move fast at Komodo Platform. That’s why the Komodo team has decided to release a weekly briefing to cover all of the progress the Dev Team is making.

This series of posts is called the Tech Tuesday Updates.

In case you’ve missed a previous edition and want to catch up, you can find all the previous Tech Tuesday updates here.

Synthetic Positions & Prices For Blockchain Based Financial Instruments

If a trustless oracle and a gateway to a 3rd party coin was combined and then imported to a new blockchain (with blockchain enforcement), and you were to include price feeds and pegs, what would you get?

Synthetic positions and prices. The ability to price any asset (tokenized or off-chain via data feed) in any asset. This is an on-chain prices reference for blockchain based financial instruments. This blockchain financial instruments

Komodo’s innovative peer to peer orderbooks for the atomic swap network already allowed for coin markets to exist that were not based on BTC prices. For instance, there could be KMD/ZEC prices listed. And these can be traded directly by traders.

What synthetic positions & prices gives the Komodo ecosystem is the ability to create new financial services with blockchain enforcement. Using the gateways consensus module, these services enable cross-protocol/cross-chain/cross-currency integration.

It is only one week into the development cycle, so we look forward to more news in the coming weeks.

Decentralized Market Price Feeds Graphed (Crypto/Fiat/Forex/etc.)

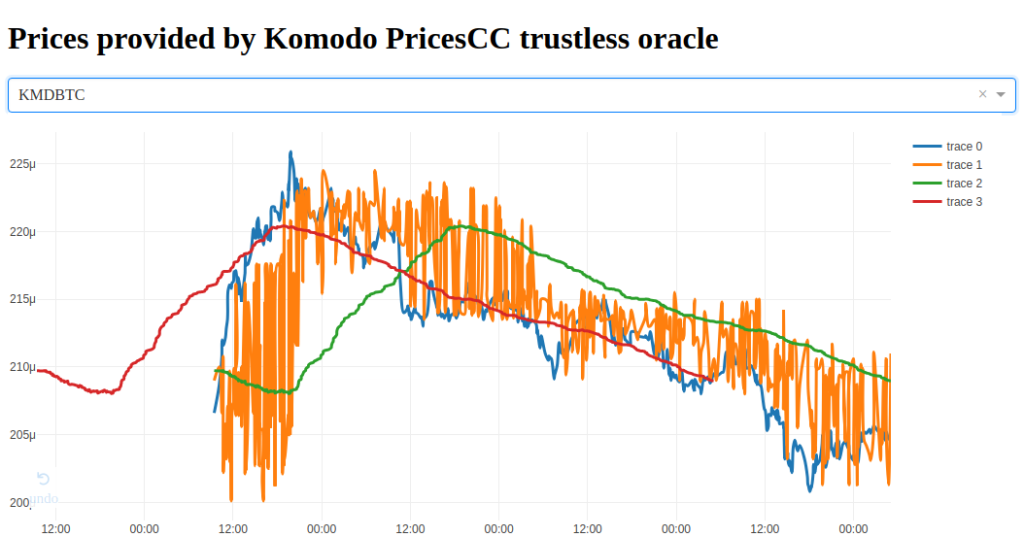

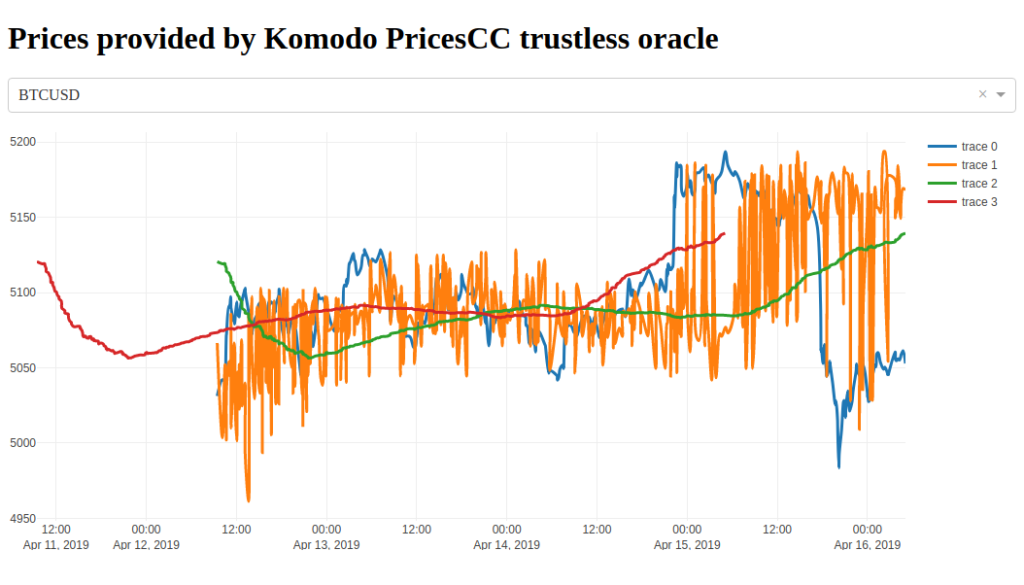

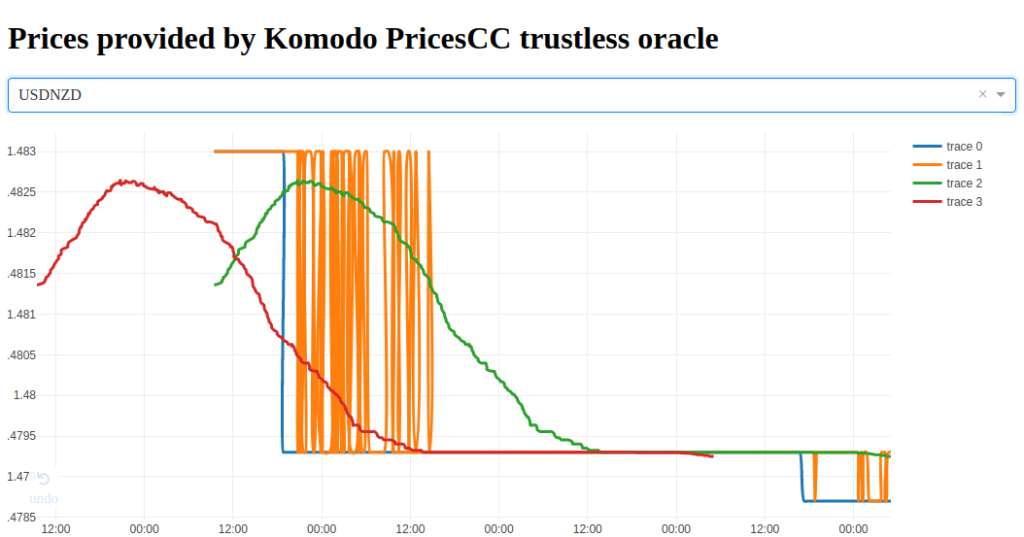

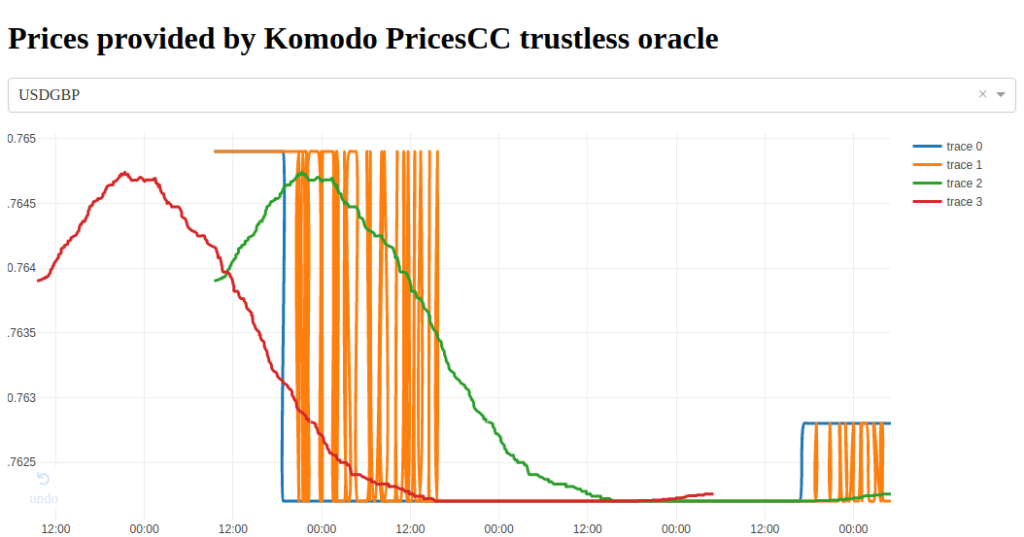

After the creation of decentralized price feeds with the new decentralized oracle developments, Komodo dApp tester TonyL created some quick real-time graphs for visualizing the price changes for this decentralized oracle. The price feeds cover cryptocurrencies & foreign exchange. Any market can be offered as a price feed to users on any network following trustless peer-to-peer principles.

The testing process includes 4 traces at different smoothness & time resolutions:

- Cryptocurrency prices

- KMD to BTC going from 0.00022500 BTC to 0.00020500 BTC during 16 April 2019

- Cryptocurrency to Fiat

- BTC to USD floating between $5050 and $5180

- Foreign Exchange

- USD to NZD $1.483 down to $1.4785 whilst the markets were open today (16 April 2019)

- Foreign Exchange

- USD to GBP $1USD buying GBP 0.765 to 0.7625 through 16 April 2019.

XMR Protocol 51% dPoW Protection talks begin with BLUR

This week, technical discussion began on the integration of Komodo’s delayed proof of work (dPoW) security mechanism to the XMR-based family of coins.

The BLUR project has expressed interest and has already done much investigation into integrating dPoW. The BLUR project shares common values with many of the developers in the Komodo ecosystem— namely decentralization & privacy. To preserve these, it is important to understand how to protect against a 51% attack.

There are some key issues that need to be overcome in order to be part of the dPoW security alliance. A similar set of issues that has been overcome in the past by the Komodo developers. Ethereum notarizations were first implemented in 2018 to test integration feasibility. The ETH protocol has no concept of a UTXO. The same is true for the XMR protocol family.

The KMD side of notarizations will remain the same, with the initial investigations showing that XMR supports multi-sig but the two main issues to overcome are:

- How to store the notarization data

- How to create a transaction that all the nodes in the network can recognize as a notarization

The issue with storing notarization data may be solvable by using the tx_extra field which is publicly viewable - it is already used by mining pools for pool nonce in some cases. The space of this field is large enough to store the transaction hash of a notarization. Win.

Decker kindly sent a link to explain the low level notarization transaction whilst Hush lead developer expressed:

BLUR is on the leading edge of research inside the XMR community, and is now integrating bleeding edge tech from the KMD world, which makes this a very exciting project.

Documentation Update

If you clicked on the previous link about the cross-protocol/cross-chain/cross-currency gateways consensus module that allows the user to facilitate, manage, and trade tokenized representations of foreign blockchain assets, then you would have seen the developer docs get a refresh. This refresh is part of the rebrand strategy - to make Komodo more appealing to developers. It is the first step in many that are taking place for the rebrand project.

Documentation is a team effort with many putting in long hours of collaboration. Special thanks goes to Siddhartha-Crypto for managing the language so that it is consistent. Although it is not complete, it’s a major milestone with many engineering diagrams to be enhanced in the coming weeks.

Native Notfications Agama Wallet & How To VOTE User Guides

A wallet update for Agama is available for the 2019 Notary Node Elections. How to vote documentation has been created:

Native notifications for the Agama Desktop wallet have arrived!