The blockchain space has a lot of terms and ideas that might go over the heads of newbies, but they are worth diving into, as they can bring a lot of additional value. One of these is crypto staking, which is a ubiquitous term that describes an activity that is growing ever more popular.

Staking crypto is a critical part of networks that are built on a system that uses Proof of Stake (PoS) verification, and the purpose of this guide is to educate you all about it. Staking could also work similar to a traditional bank account (although with my higher returns), where users deposit their tokens in order to earn interest in the form of receiving additional coins or tokens. The best crypto staking options have attracted millions of individuals, as the benefits provided are hard to ignore.

What Is Crypto Staking?

In blockchain networks, there are several ways to secure a network and its cryptocurrency. For example, Bitcoin uses the Proof of Work (PoW) consensus algorithm. Here, cryptocurrency miners complete increasingly complex computational tasks to validate transactions. They are then rewarded with Bitcoin for their contribution to keeping the network secure.

On a Proof of Stake (PoS) network, users "stake," i.e., lock up their assets to secure the network. Those who have staked will get selected at random to validate transactions on the network. Typically, those with larger stakes earn more from their contribution towards the securing of the network, as your rewards are based on your contribution.

How Does Staking Work?

As mentioned above, on a Proof of Stake (PoS) network, crypto staking is what secures the network. The funds you stake become a part of the network's securing/transaction validation process. The specifics of staking will vary from project to project, and some might have significant variations for their staking mechanics.

But it all boils down to this: stakers lock up their funds, usually through a staking pool, and steadily receive interest on that amount over time.

Which Cryptos Have Staking?

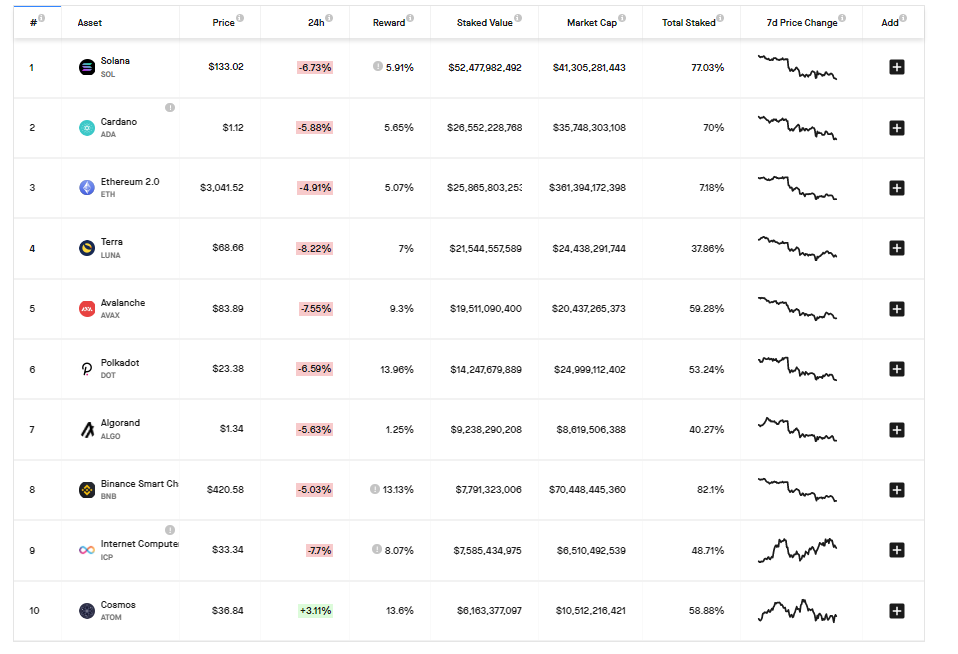

Several cryptocurrency projects support staking, from the biggest names to up-and-coming ones. We'll cover some of the major projects here and explain how staking plays a role within each of their networks.

Ethereum

Ethereum (not Ethereum Classic) supports staking, though it isn't quite fully ready yet. The network is in the midst of a transition towards PoS. Staking on ETH 2.0 launched on Dec. 1, 2021, with a minimum staking amount of 32 ETH to become a full validator. If you don't have 32 ETH, you can join a staking pool to earn rewards.

Staking on Ethereum is fairly straightforward once you have the funds for it. Bear in mind that there are some risks, like losing ETH if an attacker successfully carries out an exploit, or if your node goes offline. Furthermore, you will not be able to withdraw your stake until certain future upgrades are reached, generally making your tokens inaccessible. This will be possible when the beacon chain merges with the mainnet, but people are working on solutions in the meantime, such as synthetic and tradable ETH 2.0.

Polkadot

Polkadot (DOT), a competitor to Ethereum, also has staking but uses a Nominated Proof of Stake (NPoS) consensus mechanism.

Nominators in this system can back up to 16 validators as trusted validator candidates, with both nominators and validators locking their assets as collateral and receiving rewards for their contributions. However, the network uses a probabilistic method to dole out rewards, so not all validators will receive the exact rewards.

Solana

To stake on Solana, users delegate tokens to validators on the network. The more tokens that a validator has, the more likely they are to be chosen to validate new transactions, thus increasing the rewards they get.

However, there is also a chance of losing tokens. In a process called slashing, validators can lose some of their delegated tokens if they act with malicious intent. As a result, all token holders who have delegated their tokens to this validator will lose a portion of their delegated assets.

How To Stake Crypto

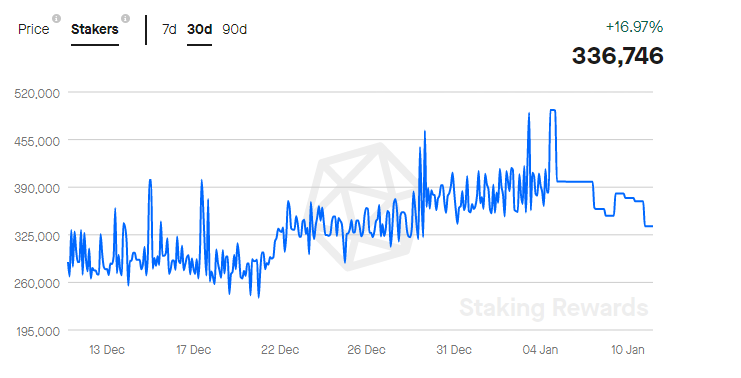

Staking crypto is reasonably straightforward, though that depends to some degree on the specific asset you want to stake. Many projects have been trying to make the process as simple as possible in order to attract as many stakers as possible. This leads to additional liquidity of their native coin getting locked up.

The first step in staking crypto is to have the relevant asset. Whether it's ETH, DOT, SOL, or any other asset, you need to have some of these tokens to stake. Once you do, you need to store it in a staking pool compatible wallet. There are several wallets that support staking on various networks natively, including Ledger and Exodus.

Assuming you have the assets and a supporting wallet, you will then need to find the staking protocol or staking pool option on these wallets. Then, you can click on the staking pool of your choice, enter the staking amount, and confirm the transaction. That's it! You are now staking your tokens and earning rewards as interest. The staking process can be different depending on the wallet and network. However, by and large, the steps listed above apply to staking most assets.

Advantages of Crypto Staking

Now that you've heard all about staking, you might want a summarized list of the benefits of crypto staking. The advantages are as follows:

- The primary advantage of staking is that you get rewarded in the native coin for your contribution.

- You can earn passive income on crypto that would otherwise be idly sitting in a wallet.

- Staking is more environmentally friendly than mining.

- Staking is more democratic than the traditional crypto mining process since practically anyone can stake without needing special hardware or technical knowledge.

- Locking funds via staking contributes towards network security.

Risks of Crypto Staking

Cryptocurrency staking might sound like a dream, but it's not without some drawbacks. The following is a list of disadvantages related to staking cryptocurrencies:

- You could lose some value within your staked assets because of price movements. This could outweigh the interest you earn.

- Lockup periods can be long, making your tokens inaccessible.

- There is a minor chance that you could lose your stake because of a hack (depending on the platform or network and its security).

Staking Can Be Lucrative in the Long Run

Now that you understand crypto staking, you can go ahead and try it yourself. It’s clearly the better alternative to mining and is undoubtedly more equitable. However, you will still need some capital to get started staking. Decentralized exchanges are good places to find tokens that allow staking.

Staking can bring a solid amount of returns in the long run, and, of course, you are helping secure a blockchain network. It’s an integral part of the crypto market and one aspect that will continue to be essential to the future of the space.

📧Komodo Newsletter

If you'd like to learn more about blockchain technology and keep up with Komodo's progress, subscribe to our newsletter. Begin your blockchain journey with Komodo today.