Before you consider buying XRP with a credit card, it is essential to understand what XRP brings to the table. In this guide, we’ll look at how to buy XRP with credit card and how to buy XRP with debit card.

XRP's Origins

Ripple Labs Inc., founded in 2012, created XRP as a native token for its Ripple blockchain. This network aimed to make the international payment system more cost-effective, one in which transactions are executed without delay, no matter the country of origin and destination. For this purpose, the XRP Ledger is all about securing international, borderless payments, with the ambitious goal to eventually replace the current SWIFT system.

The network itself, called RippleNet, services over 300 financial institutions worldwide. CEO of Ripple Labs, Brad Garlinghouse, once described the relationship between XRP and Ripple as one between an oil company and oil.

"We own a lot of XRP. But it's a little bit like saying, Exxon owns a lot of oil."

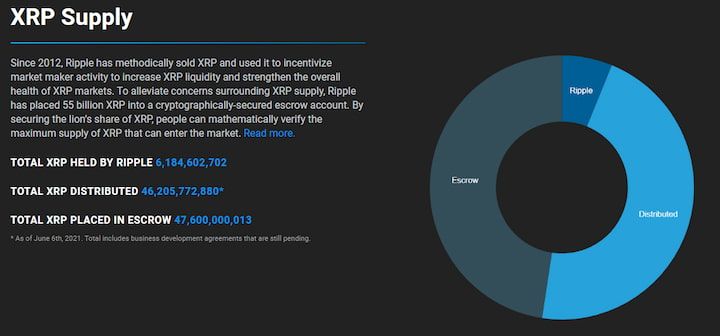

Meaning, the company itself owns a big chunk of XRP, slightly less than 50% of its total supply. This accounts for approximately 47.7 billion XRP tokens out of the 100 billion XRP total supply. From the get-go, the company used quarterly XRP sales as a funding mechanism to continue the development of RippleNet, bringing more financial institutions into its fold. In other words, XRP is unlike most top cryptocurrencies because of its heavy centralization.

Furthermore, those who wish to run full-nodes for the XRP blockchain must seek the company's approval via its Unique Node List (UNL). This is in stark contrast with a decentralized cryptocurrency like Bitcoin (BTC), in which anyone can run a full node. Reminder, blockchain is a distributed ledger across nodes, where each one contains a copy of the entire ledger.

This way, when someone makes a transaction, it is forever recorded on the blockchain and synced up across all nodes, making blockchain records virtually impossible to falsify unless a single entity controls the majority of full nodes. Such a hypothetical danger is commonly referred to as a 51% attack.

XRP's Unique Value Proposition

When it first launched in 2012, XRP unleashed its total hard capped supply of 100 billion tokens. This means that XRP Ledger doesn't have any mining mechanism because all tokens are already pre-mined. In turn, this translates to XRP running on a highly efficient consensus mechanism with an average transaction settlement time of about 3–5 seconds.

Unlike Bitcoin's Proof of Work (PoW) consensus mechanism, which requires a computational toll for issuing new BTC and verifying transactions, XRP Ledger relies on validators. Only those validators listed on the UNL will have a say in implementing any changes to the XRP Ledger, and only if there is a consensus of 80% across nodes for at least two consecutive weeks.

In this sense, the XRP cryptocurrency is decentralized, but not nearly as much as a network like Ethereum (ETH), hosting over 90,000 active validators. In contrast, the Ripple network has about 100x less, at only 900 nodes. However, the XRP network offers top transaction speeds that surpass even Visa or Mastercard, which also easily trumps the SWIFT network.

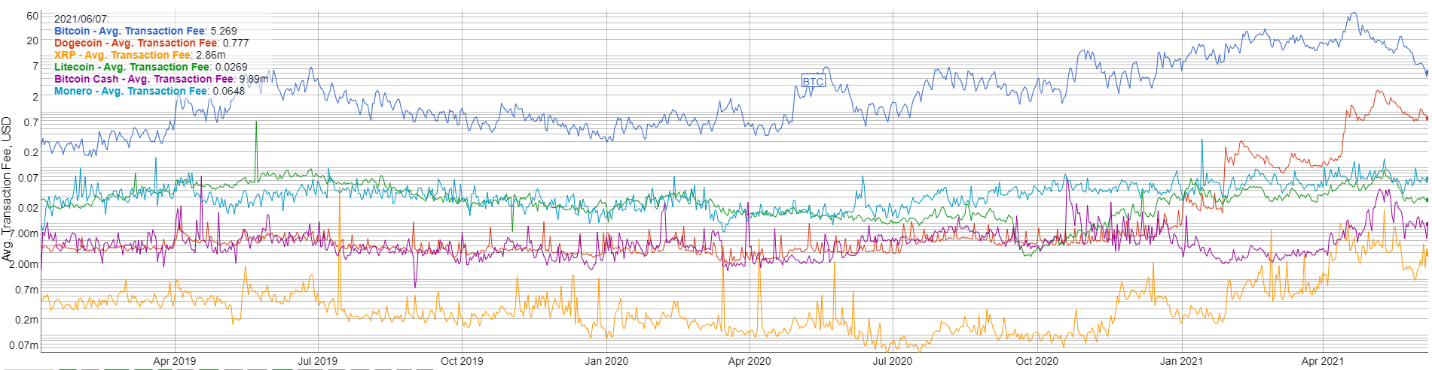

Moreover, because the XRP Ledger is distributed, there is no payment downtime over the weekend as it exists with almost all banks. Anyone can make payments via XRP 24/7 within about 3 seconds. Most importantly, the transactions are nearly frictionless — charging only 0.00001 XRP per transaction. This translates to $0.000009 as of June 2021. In comparison, credit/debit card payments from most banks have a flat fee at a minimum of $0.20. These differences make XRP a vastly superior vehicle for borderless, instant payments.

Is Ripple in Trouble with the Law?

As of May 30, 2021, the start-up company Ripple Labs holds 47.7 billion XRP in its escrow account. This accounts for 47.7% of the currency's total supply of 100 billion. Now, imagine if a whale with that market power existed for Bitcoin. Such a whale would have enormous power to lower or elevate the price of XRP.

Even worse, what if the company itself is under scrutiny for using XRP tokens to fund its projects? Then, the XRP price would be highly dependent on the outcome of such scrutiny. This is the case with XRP when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs Inc. at the end of last year.

The SEC complaint alleges that Ripple Labs acquired over $1.3 billion through an unregistered digital securities offering — selling XRP tokens. Although the matter is still unresolved, there are some indicators that it will result in a pre-trial settlement, which is the case with 96% of cases that the SEC brings up. In such a scenario, Ripple would have to pay a penalty in addition to limiting XRP sales from their escrow account.

However, it may even turn out that Ripple will win the case on the grounds of Fair Notice defense, meaning that the SEC failed to issue reasonable, fair notice on selling XRP as an illegal securities offering. Either way, XRP has grown considerably since its launch, situating itself as one of the few players that can offer instant payments for nominal fees.

XRP Price Predictions: Should You Invest in XRP?

Notwithstanding the SEC lawsuit, XRP has inherent value as a global payment network. Even in the worst-case scenario, which doesn't seem likely at this point of the legal proceedings, less than half of XRP tokens are already out of the hands of Ripple Labs. If they win the case, you may have the opportunity to see your XRP investment rapidly surge in value.

Many institutional investors have brought the network to the point of the XRP token getting accepted by over 75 banks that operate on a global level, with Santander using its xCurrent protocol for cross-border payments. Even Bank of America has been a Ripple partner since 2016. While, for some, this may go against the spirit of the original cryptocurrency vision that sought to supplant the banking system, the fact remains there are few choices left for the specific purpose of daily payments. Accordingly, XRP has regularly stayed within the top 10 cryptocurrencies by market capitalization. The XRP token holds 7th place at a $40.5 billion market cap as of June 2021.

XRP's all-time-high (ATH) price was on January 4, 2018, at $3.36. On April 15, 2021, XRP reached $1.82, and is currently holding at $0.87. Considering these historical price points, XRP may be in the buy-the-dip stage and poised to spike when the SEC lawsuit outcome is resolved. Furthermore, it must not go unnoticed that whales used the May 2021 crypto crash to go on a buying spree, while novice crypto investors succumbed to panic-selling.

Because the fate of altcoins tightly correlates with Bitcoin's price moves, as the dominant cryptocurrency with over 60% market cap of the entire crypto space, this tells us that XRP is in a similar position. Moreover, you will not see XRP maligned by the financial media because of its costly mining network. Remember, XRP Ledger (XRPL) uses energy-friendly validators instead of Bitcoin's miners.

Lastly, the outlook for XRP is looking good because it is not subject to national laws or inflation spikes. On the contrary, XRP's finite supply is inherently deflationary, making it a potential hedge against growing inflation rates all across the world, from Nigeria to the United States. This can also be said of Bitcoin, but it transitioned more into a store of value — digital gold — rarely used for frictionless, instant, borderless payments on a regular basis like XRP. In this domain of cryptocurrencies as payments, also consider buying Litecoin with a credit card. Otherwise, here is the easiest way to buy XRP online.

How to Buy XRP with Credit Card or Debit Card?

First, you should look at the different factors involved when buying crypto with a credit card. These include exchange requirements, fees, and what kind of payment methods and payment withdrawals they allow. For instance, direct transfers via SEPA, ACH, or FPS regularly have the minimum transaction fees possible, especially compared to debit/credit cards.

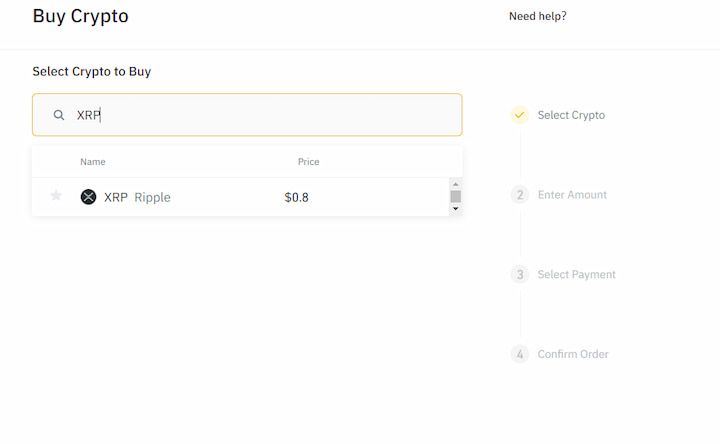

There are a few ways to buy XRP instantly. To access the broadest range of payments and withdrawal methods, a safe bet would be to go to Binance, the world's largest crypto exchange. It also has its own mobile app, which you can find here for Android devices, or here for Apple devices. From here, it's a simple matter of following the authentication and verification steps and linking your credit card to your account to buy XRP instantly, which can be via VISA or MasterCard. Currently, it’s not possible to buy XRP with PayPal.

Please note that Binance, like all legal exchanges, must follow AML (anti-money laundering) and KYC (know-your-customer) protocols. Therefore, make sure you have the photos of your documents uploaded to your device beforehand, usually a national ID (front and back) or a passport. After Binance completes the verification of your identity, you can either buy XRP directly with a credit card, or purchase stablecoins for later use. Stablecoins are digitized fiat currency, meaning that they are pegged to a national currency in a 1:1 ratio. The most popular stablecoins are Tether (USDT) and USD Coin (USDC). Many consider them as general account money.

Because stablecoins themselves are cryptocurrency, once you have them on your account, you will be able to buy any crypto on Binance instantly. Currently, this enormous list contains over 500 cryptocurrencies and virtual tokens. Likewise, you will be able to deposit and exchange them for XRP and vice-versa.

📧Komodo Newsletter

If you'd like to learn more about blockchain technology and keep up with Komodo's progress, subscribe to our newsletter. Begin your blockchain journey with Komodo today.