In the ever-evolving landscape of cryptocurrencies, stablecoins have emerged as a crucial component, providing stability and a bridge between traditional finance and the digital realm. One such stablecoin that has garnered attention for its innovative approach is Dai (DAI).

In this article, we will delve into the intricacies of Dai, exploring its creation, unique features, and reasons behind its increasing popularity.

What is Dai (DAI)?

At its core, Dai is a decentralized stablecoin designed to maintain a value pegged to the US Dollar. This stability is achieved through an ingenious combination of smart contracts and collateralized assets. Unlike traditional cryptocurrencies, Dai aims to offer users the benefits of digital currencies without the inherent volatility.

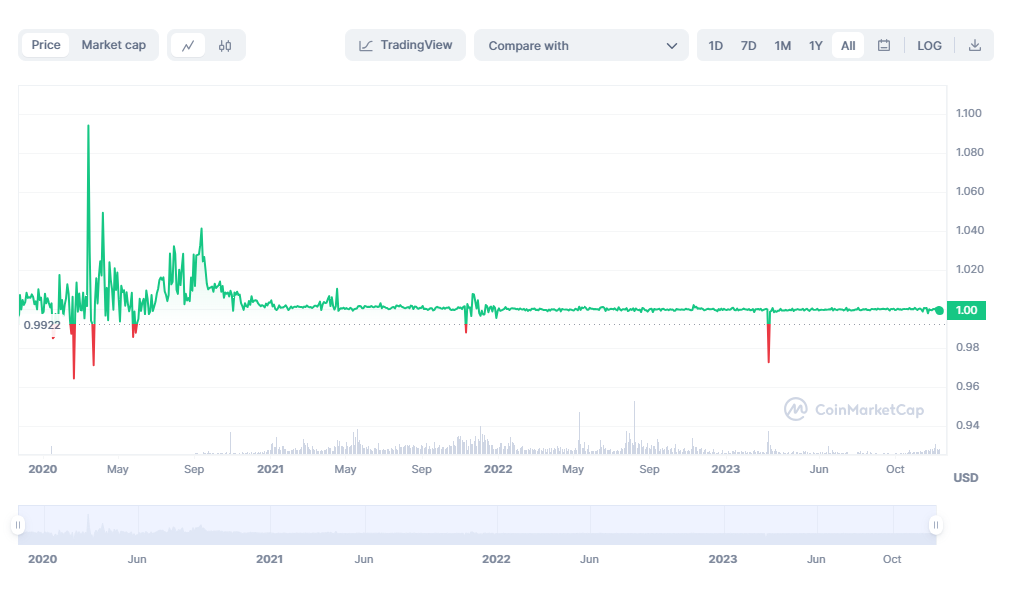

Stablecoins are a subset of cryptocurrencies that aim to minimize price volatility, making them more suitable for everyday transactions and financial activities. Dai achieves this stability by pegging its value to the US Dollar. For every 1 Dai, its value should ideally equal $1.00 USD.

The Role of MakerDAO in Creation and Governance

MakerDAO plays a pivotal role in the creation and governance of Dai. MakerDAO is a decentralized autonomous organization (DAO) built on the Ethereum blockchain. It operates the Maker Protocol, which, among other things, facilitates the creation of Dai through a process known as collateralized debt positions (CDPs). Holders of the native MKR token have voting rights in the governance of MakerDAO, making it a community-driven project.

How Does Dai Work?

Dai's operation involves a complex yet robust mechanism. Users can generate Dai by locking up collateral assets in CDPs. These collateral assets, which are primarily cryptocurrencies like Ethereum (ETH), act as a security net, ensuring that the value of Dai remains stable. If the value of the locked assets falls below a certain threshold, liquidation occurs to maintain the peg.

Who Are the Founders of Dai?

Dai, being a product of the decentralized governance model of MakerDAO, doesn't have traditional founders in the conventional sense. The creation and development of Dai are attributed to the collaborative efforts of the MakerDAO community, making it a project driven by the collective intelligence of its participants.

What Makes Dai Unique?

Dai distinguishes itself from other stablecoins through its decentralized nature and the innovative approach to maintaining its peg. Unlike many centralized stablecoins, such as Tether (USDT), that rely on reserves held by a central authority, Dai uses smart contracts and collateral to achieve stability. This decentralization enhances transparency and reduces the risk of manipulation.

What Gives Dai Value?

The value of Dai is derived from the collateral assets locked in the system. As long as these assets maintain their value and the governance mechanisms function effectively, Dai remains stable and holds its peg to the US Dollar. The confidence in Dai's value is bolstered by the transparency of the collateralization process and the decentralized nature of the protocol.

Why Use Dai?

Dai offers several advantages that make it an attractive option for users:

- Stability: The primary benefit of Dai is its stability, providing a reliable store of value for users in the volatile world of cryptocurrencies.

- Decentralization: Dai operates on the principles of decentralization, reducing the risk of central authority manipulation and enhancing trust among users.

- Global Accessibility: Being a digital asset, Dai allows for borderless transactions, enabling users to send and receive value across the globe without the need for traditional banking intermediaries.

- Lending and Borrowing: Decentralized applications (dApps) such as Spark enable users to deposit DAI to earn interest and borrow DAI against ETH, stETH, rETH and other assets.

How to Choose a Dai Wallet?

Choosing the right wallet is crucial for securely storing and managing Dai. There are various wallet options, ranging from hardware wallets for maximum security to user-friendly mobile wallets. Factors to consider include security features, user interface, and compatibility with your preferred platform.

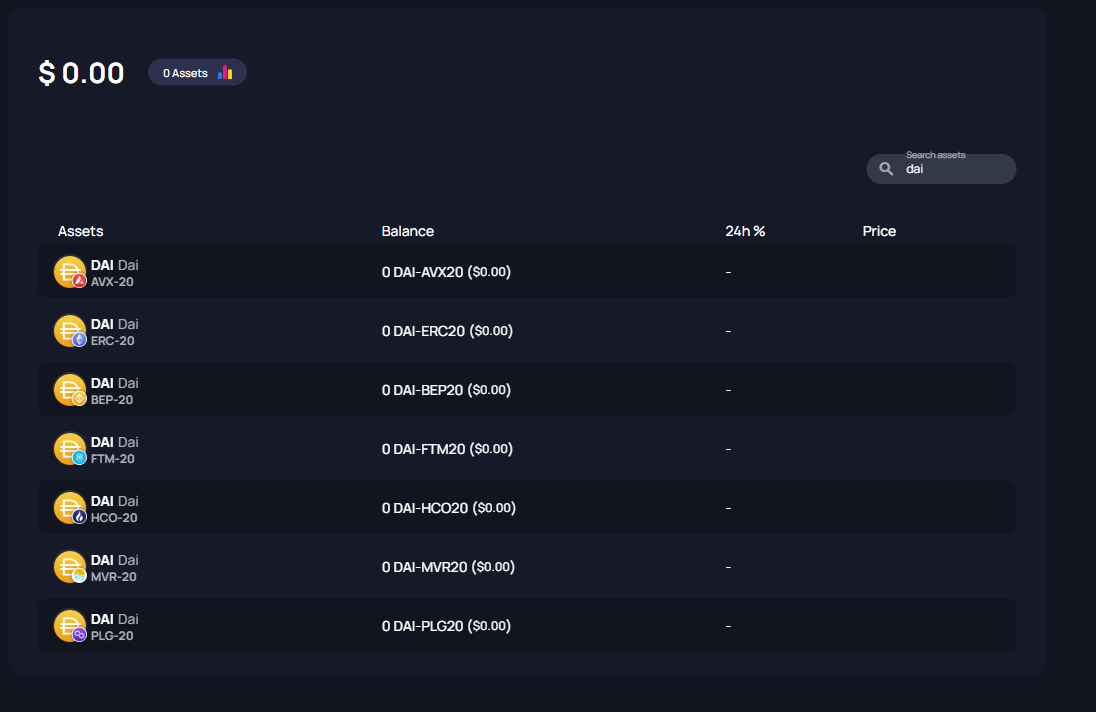

Komodo Wallet, for example, provides a versatile option since it supports Dai across multiple blockchains.

How to Buy Dai?

Acquiring Dai involves a simple process. Users can purchase Dai from cryptocurrency exchanges that list it. The most common method is to exchange other cryptocurrencies, such as Bitcoin or Ethereum, for Dai.

Some exchanges and fiat on-ramps also make it possible to purchase Dai with fiat currencies such as USD. Make sure to use reputable exchanges and follow best practices for secure transactions.

Dai Stablecoin FAQ

Is 1 DAI always worth exactly 1 USD?

In theory, yes. Dai is designed to maintain a 1:1 peg with the US Dollar. However, slight fluctuations may occur due to market dynamics and the effectiveness of the governance mechanisms in place.

What happens to MakerDAO after an emergency shutdown?

In the event of an emergency shutdown, MakerDAO's smart contracts are triggered to settle outstanding positions and distribute remaining collateral to Dai holders. This ensures that the system remains solvent and maintains the stability of Dai.

Is Dai a safe coin?

Dai's safety is derived from its decentralized nature, transparency, and the collateralization of assets. While no investment is entirely risk-free, Dai's design aims to mitigate risks associated with price volatility and centralization.

Is Dai backed by Ethereum?

Dai is not directly backed by Ethereum, but it is built on the Ethereum blockchain. The collateral assets used in the Dai ecosystem are primarily cryptocurrencies, with Ethereum being a common choice. The relationship between Dai and Ethereum is more of interoperability than direct backing.

Conclusion

Dai has emerged as a pioneering stablecoin, providing a stable and decentralized alternative in the world of cryptocurrencies. Its unique approach to maintaining stability through collateralization and decentralized governance sets it apart.

As the cryptocurrency landscape continues to evolve, Dai's role in bridging the gap between traditional finance and decentralized ecosystems is likely to grow.

DAI Available on Komodo Wallet

Komodo Wallet is a non-custodial wallet, crypto bridge, and peer-to-peer (P2P) decentralized exchange that provides native support for the Ethereum blockchain and the Dai token.

Users can HODL and trade DAI along with other popular cryptocurrencies such as BTC, ETH, DOGE, MATIC, and much more.