In recent years, the rise of cryptocurrency has reshaped the financial landscape, offering new avenues for investment, transactions, and financial autonomy. As digital assets gain mainstream recognition, the need for effective asset management tools becomes increasingly apparent.

Two primary tools stand out: cryptocurrency exchanges and cryptocurrency wallets. This article explores the fundamental differences between them, aiming to provide readers with the knowledge necessary to navigate the crypto space confidently.

Key Takeaways

- Both crypto exchanges and crypto wallets are essential tools in the crypto ecosystem with distinct functions

- Crypto exchanges are digital marketplaces for trading cryptocurrencies, offering liquidity and price discovery.

- Centralized exchanges (i.e. Binance, Coinbase) hold user funds; decentralized exchanges (DEXs) (i.e. Komodo Wallet) don't hold user funds.

- Crypto wallets store, send, and receive cryptocurrencies, and most give users full control over their assets.

- Understanding the difference between crypto wallet and exchange is critical to managing your assets wisely.

Exploring Cryptocurrency Exchanges

Cryptocurrency exchanges function as digital marketplaces where users can trade cryptocurrencies.

The operation of cryptocurrency exchanges involves a straightforward process of placing orders to buy or sell cryptocurrencies. Users can navigate through the platform's interface to execute trades based on current market prices. Exchanges offer a wide range of cryptocurrencies, providing users with ample options for asset diversification.

These platforms play a pivotal role in the crypto economy, providing liquidity and enabling price discovery for various digital assets. Exchanges come in two primary forms: centralized and decentralized.

Centralized exchanges, such as Binance or Coinbase, operate as intermediaries, matching buyers and sellers while holding custody of users' funds.

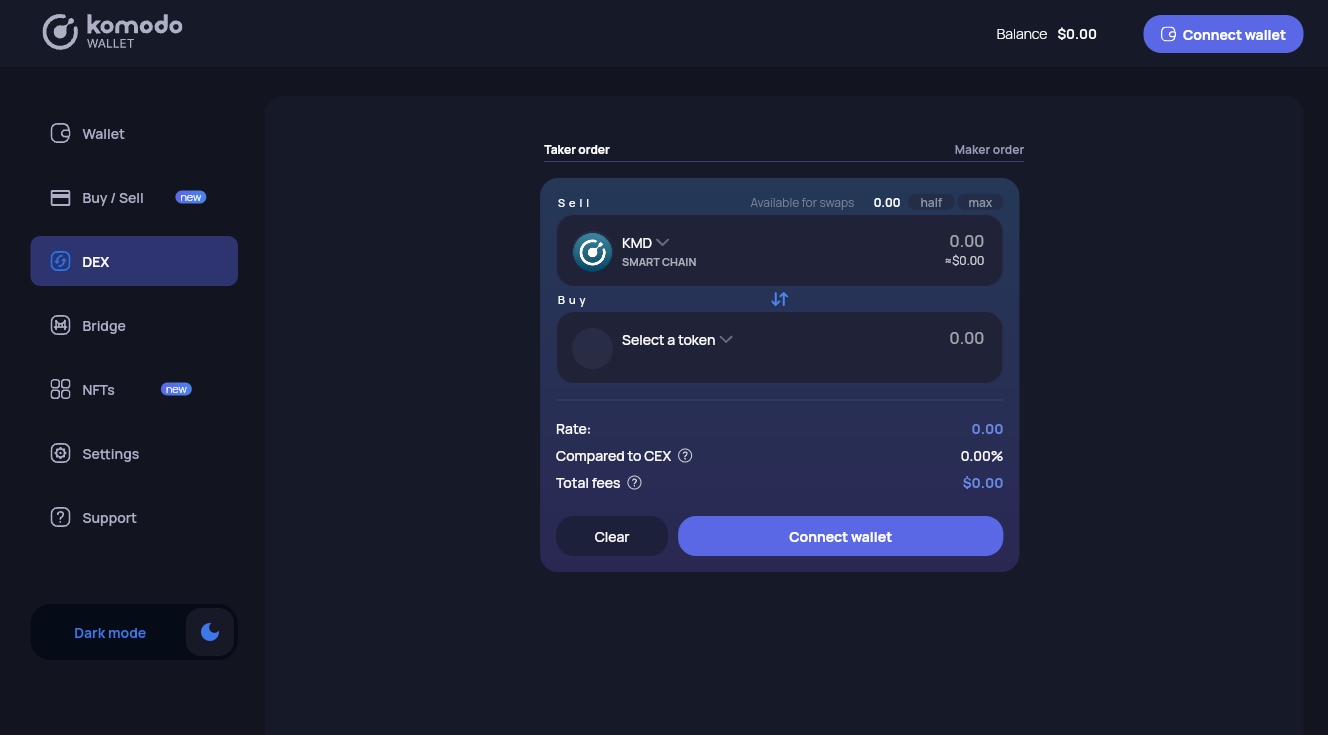

Decentralized exchanges (DEXs), such as Komodo Wallet’s DEX, are protocols that leverage blockchain technology to enable crypto trading without the need for a central authority. Decentralized exchanges either a) have a built-in non-custodial wallet OR 2) allow users to connect an external non-custodial wallet when trading.

Understanding Cryptocurrency Wallets

Cryptocurrency wallets serve as digital repositories for storing, sending, and receiving cryptocurrencies. They play a crucial role in the ecosystem by providing users with total control over their digital assets. There are a variety of crypto wallet types, including hardware, software, and paper options, each offering distinct advantages and disadvantages.

Hardware wallets, such as Ledger or Trezor, offer unparalleled security by storing private keys offline, protecting users from online threats. Software wallets, like Komodo Wallet, provide convenience and accessibility, allowing users to manage their assets via web, desktop, or mobile applications. Paper wallets, though less common, offer another way to store private keys offline via a physical medium, such as a QR code printed on paper.

The underlying mechanism of crypto wallets revolves around private keys and public addresses. Private keys, akin to long-form passwords backed by cryptography, grant access to one's cryptocurrency holdings, while public addresses serve as an easily shareable destination for receiving funds. Encryption ensures the security of transactions and protects users' assets from unauthorized access.

The benefits of using a secure crypto wallet extend beyond security to include control and direct transactions. By managing one’s private keys, users retain full control over their funds, eliminating reliance on third-party entities. Additionally, crypto wallets facilitate peer-to-peer transactions, enabling users to send and receive funds directly, without intermediaries.

How is a cryptocurrency exchange different from a cryptocurrency wallet

While both a crypto exchange and wallet are vital tools in the digital asset space, they are designed for different functions. A crypto exchange is intended for market interaction - buying, selling, and trading - while a crypto wallet is designed to hold and protect your funds.

Control and custody

Control and custody represent one of the primary distinctions between crypto wallets and exchanges. While non-custodial wallets (a.k.a. self-custody wallets) grant users full control over their private keys, centralized exchanges hold custody of users' funds. This disparity in control has significant implications for security and access, as users rely on exchanges to safeguard their assets.

Security

Exchanges can be vulnerable to hacks due to the large volume of assets they manage. While some offer insurance or security features, risks remain. Wallets - particularly cold wallets - are less prone to attacks. However, if you lose your private key or seed phrase, access to your crypto is lost permanently.

Connectivity

Exchanges operate entirely online, allowing you to trade anytime. Wallets differ by type. Hot wallets are connected and useful for regular transactions, while cold wallets are used offline for safer, long-term storage. This difference is especially relevant when evaluating crypto exchange vs crypto wallet for different user needs.

Anonymity

To comply with regulations, most exchanges require users to undergo KYC (Know Your Customer) verification. Wallets, especially non-custodial ones, offer more privacy, although all transactions are still recorded on public blockchains. This is an important aspect of the difference between crypto wallet and exchange.

Ease of use

Centralized exchanges are generally beginner-friendly, offering clean interfaces and guides. Wallets require more knowledge, particularly about securing your recovery phrases and managing private keys. That said, learning to use a wallet is a vital step toward full crypto self-sovereignty. Anyone exploring exchange vs wallet should weigh ease of use against control.

Making the Right Choice for Your Crypto Needs

For beginners entering the crypto space, exchanges offer a straightforward starting point, providing liquid markets to trade a wide range of cryptocurrencies. As users gain experience using cryptocurrencies and seek greater control over their assets, transitioning to self-custody wallets becomes increasingly appealing.

Experienced users interested in self-custody can benefit from utilizing crypto wallets to take control of their digital assets fully. By managing their private keys, users eliminate reliance on third-party entities and gain autonomy over their funds. Wallets offer peace of mind and protection against potential centralized exchange security breaches.

A hybrid approach combining wallets and exchanges presents another option for managing crypto-based financial plans.

Moving Assets: From Exchange to Wallet

Transferring cryptocurrencies from a centralized exchange to a self-custody wallet involves a simple yet critical process.

Users must first create a self-custody wallet, either by purchasing a hardware wallet or choosing a software-based wallet. Once the wallet is set up and the user has recorded their seed phrase (and stored them securely offline), one must find their crypto wallet address, which is a unique identifier used for receiving funds.

Initiating the transfer from the exchange requires selecting the desired cryptocurrency and specifying the recipient's wallet address. Users must verify the transaction details and confirm the transfer. Upon completion, the transferred funds will appear in the designated wallet, ready for secure storage and management.

Unlike traditional bank transfers, crypto transactions can’t be reversed. That’s why it’s crucial for users to verify they are sending the correct asset to the correct address. For example, users must send Bitcoin (BTC) to a Bitcoin wallet address and Ethereum (ETH) to an Ethereum wallet address. Just one incorrect alphanumeric character in the receiving address will lead to a loss of funds.

Common Mistakes to Avoid

New users often make avoidable errors:

- Leaving large amounts of crypto on exchanges long-term.

- Misplacing or failing to back up wallet seed phrases.

- Falling for fake apps, phishing websites, or fraudulent emails.

- Not enabling two-factor authentication (2FA).

- Choosing the wrong tool for their use case - confusing a crypto wallet vs exchange.

Understanding how each tool works is crucial for managing risk and staying in control of your digital assets.

Exchange vs Wallet: Your Next Step

In the crypto world, understanding the difference between a crypto exchange vs crypto wallet is essential. One facilitates trading, while the other ensures secure storage. Both serve different needs and, when used together, offer a well-rounded strategy for anyone managing digital assets. To get started, define your crypto goals. Choose the right tools for the right tasks. Evaluate what matters more to you - accessibility or control.

Komodo Wallet is a non-custodial wallet, decentralized exchange, and crypto bridge all rolled into one app.

Komodo Wallet supports popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH) and ERC-20 tokens, Dogecoin (DOGE), Polygon (MATIC), and more.

FAQs

Can I trade directly from a wallet?

Yes, some wallets include built-in decentralized exchange (DEX) functionality, allowing peer-to-peer trading.

Can I use multiple wallets for different cryptocurrencies?

Yes, you can use separate wallets to manage different cryptocurrencies or even use multi-currency wallets that support various assets in one place.

Do wallets charge fees like exchanges?

Wallets themselves typically don't charge fees, but blockchain networks often require a transaction fee (like gas fees) when sending crypto.