As the first project to implement blockchain sharding, Zilliqa is known as an industry leader in on-demand blockchain scalability.

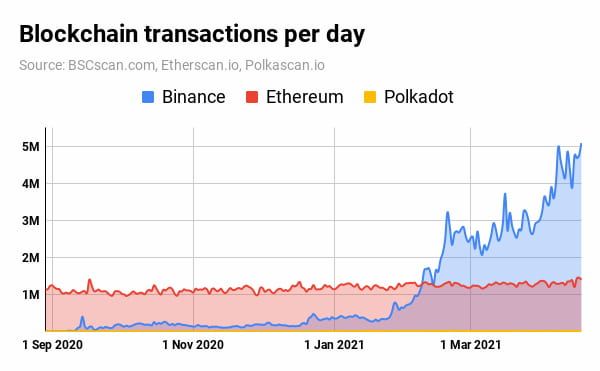

In the first half of 2021, many fled exorbitant Ethereum gas fees to a more centralized Binance Smart Chain (BSC) for DeFi, yield farming, and general cost savings. Despite having drastically fewer network nodes, BSC offers nominal transaction fees and high throughput, attracting many users. Until a new transaction validation solution is implemented, this is a disadvantage of more decentralized blockchains like Ethereum. As we see with most blockchains, the higher the node number, the more difficult and expensive it becomes to reach consensus. Through sharding, Zilliqa aims to resolve this exact scalability problem.

What Is Zilliqa (ZIL)?

Imagine having a single two-lane road between two cities with multi-million population sizes. The congestion would be intolerable, and the gas expended to wait in line would be more than one would be willing to spend for most occasions. Residents of the cities would likely avoid traveling, or maybe even move to another city. This is precisely what happened to Ethereum against the eight-lane (but more centralized) BSC.

Ethereum is in the process of implementing sharding with its ETH 2.0 transition into Proof of Stake (PoS) consensus. Zilliqa is unique in that it is the first blockchain to have fully developed sharding - a technology that supports the scaling up of a network's throughput as demand for the network grows. So, for example, if the metaphorical cities were to have grown from 100k residents to 1 million residents, under Zilliqa's governance, the roadways would be upgraded from two-lane to eight-lane and beyond, whatever the size demands, into infinity.

Zilliqa's scalability then translates into a theoretically unlimited number of transactions processed per second, only limited by the number of nodes on the network. This makes Zilliqa a high throughput blockchain ideal for enterprises that need a blockchain for computation-intensive tasks, such as modeling, data mining, machine learning, etc. With a sharded network, each task is distributed across partitioned shards instead of linearly via a single chain.

Because sharding offers greater efficiency, it has been favored by gaming studios for the last five years to improve server performance while reducing costs. The main difference is that implementing sharding on decentralized ledger technology (DLT) solutions like blockchain is far more complex.

How Does Zilliqa (ZIL) Work?

Many people are under the impression that Proof of Stake consensus is directly tied to sharding because both are on the Ethereum 2.0 roadmap. Zilliqa shows this is not the case because its blockchain actually uses Proof of Work (PoW) consensus. More precisely, Zilliqa uses a combination of PoW with BFT — Byzantine Fault Tolerance — both of which work in tandem. PoW is used by Bitcoin, while BFT is used to reach consensus even when some nodes fail to respond.

To comprehend the importance of sharding and scalability, one has to first understand the role of blockchain nodes. As the word itself denotes — blockchain — is composed of cryptographically chained data blocks. Such blocks are stored on a computer — known as a node, with multiple nodes forming a blockchain network. Whenever a transaction is conducted, or a new block is added, it is recorded on all nodes within a network.

Therefore, if someone wanted to falsify a record, they would have to do so on all nodes of the network, which is virtually impossible to achieve. After all, if that had occurred, Bitcoin's price would have collapsed a long time ago and never recovered. With thousands of nodes in place to secure and decentralize the network, you can see why decentralization is beneficial but technically problematic. The limitation of blockchain is that every computational task has to be verified across every single node, which limits the number of possible transactions per second.

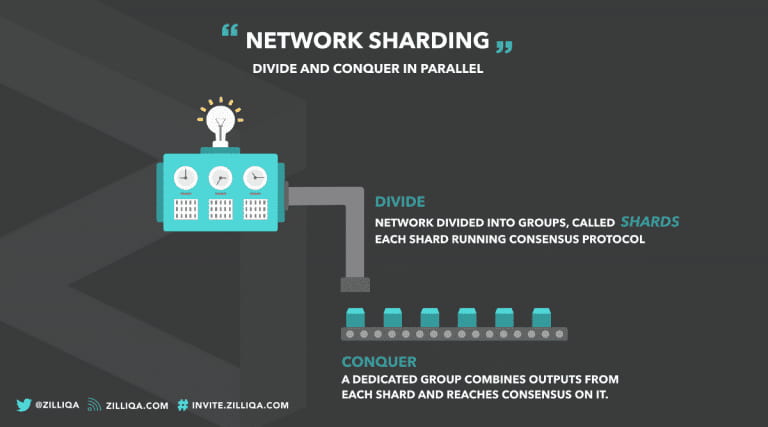

Zilliqa solved this limitation by sharding in the following example:

- Its blockchain network has 1000 nodes.

- Zilliqa shards them into 10 shards with 100 nodes each — known as microblocks.

- When a transaction is put forward, those 10 shards process a smaller chunk of the transaction in parallel with other microblocks.

- Once the processing is complete, microblocks are assembled and added to the blockchain.

The Zilliqa team calls this sharding process "divide and conquer in parallel", as shown below.

Accordingly, Zilliqa already provides scalability that Ethereum has yet to achieve, while simultaneously offering drastically low fees, currently at $0.000023 per ZIL transaction.

In contrast to Zilliqa's 360 tps on just one shard, the pre-upgraded Ethereum processes around 15 tps. Lastly, unlike Ethereum, which uses Solidity for building smart contracts, Zilliqa uses a custom-built blockchain programming language called Scilla. This language has undergone a peer-reviewed process to remove security issues known to pop up in Solidity.

Who Is Behind Zilliqa?

Dr. Amrit Kumar is in charge of Zilliqa development. Although his doctorate is in philosophy, his master's degree is in cryptology, both of which he gained in France. His team is equally impressive, with CEO Xinshu Dong holding a Ph.D. in Computer Science from the National University of Singapore. Likewise, Prateek Saxena, the Chief Scientific Advisor, has a Ph.D. in Computer Science from the University of California, Berkeley. Other notable members and advisors are Loi Luu, the co-founder of Kyber Network, and Alexander Lipton, the CEO of StrongHold Labs.

After the initial funding round in 2017, Zilliqa raised about $12 million in ETH. In 2018, they raised another $22 million via ICO (Initial Coin Offering). In the meantime, as an enterprise-grade blockchain, Zilliqa has partnered with Deloitte and FwD for blockchain-based insurance, the Mintable NFT marketplace, private Hg Exchange, Singapore-based FinTech firm Xfers, and Mindshare and PepsiCo to develop Aqilliz blockchain platform for the advertising sector.

ZIL Crypto Tokenomics

ZIL – Zilliqa's native coin – launched in 2017 with a max supply of 21 billion tokens (with a total supply of over 14.7 billion ZIL as of June 2021). In 2020, ZIL completed its token migration from the Ethereum blockchain to its own native chain, meaning it is no longer an ERC-20 token. Today, ZIL is also available as a BEP-20 token on BSC.

On its native chain, ZIL functions as both a governance token and as a cryptocurrency for funding the project. Like with Bitcoin and BTC, Zilliqa's Proof of Work consensus yields block rewards paid out in ZIL coin. However, unlike some other blockchains, mining rewards decay over a 10-year period to stabilize Zilliqa's hashrate.

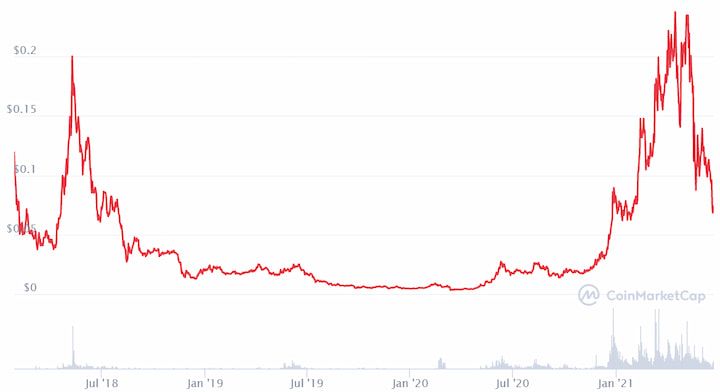

Furthermore, Zilliqa miners can use commercial-grade GPUs for mining instead of dedicated ASIC machines. Given the exceedingly low price at around $0.000023 per transaction, ZIL is well-suited for microtransactions used in various decentralized applications (dApps). Zilswap, a dApp developed in October 2020 in collaboration with Switcheo, provides a decentralized exchange (DEX). In April 2021, Zilliqa launched Zilswap (ZWAP) as the DEX's governance token. The ZIL token price was doing quite well in 2021, until the crypto market crashed in May due to a variety of factors.

The Zilliqa coin price ATH was on April 16, 2021, at $0.2376. Since then, ZIL has fallen by almost 70% to $0.0734 as of June 2021. With Cardano (ADA), Polkadot (DOT), and Ethereum (ETH) using similar scalability solutions, it might become more difficult for Zilliqa price to increase substantially compared to these coins. After all, ZIL has a market cap of under one billion — $837.9 million and currently lacks a mature dApp ecosystem by comparison.

Where to Buy Zilliqa

Nonetheless, if you are wondering where to buy Zilliqa coin to diversify your DeFi portfolio, there are several popular exchanges to choose from, including Binance, Huobi, KuCoin, and more.

If you’re looking for an app that enables you to store or swap BEP-20 ZIL, look no further than Komodo Wallet. This ground-breaking application not only supports DEX trading for thousands of crypto assets but also serves as a non-custodial crypto wallet. With Komodo Wallet, you own your private keys and have complete control of your funds.