DODO is a project that aims to solve decentralized exchange limitations through a proactive market maker (PMM) - a unique solution that offers an alternative to automated market maker (AMM) technology.

Before the financial crisis of 2008, entrepreneurs and theoreticians across the world have struggled to create an alternative to both central banking and centralized stock markets. A year later, Bitcoin emerged onto the scene as a decentralized cryptocurrency. However, only after Ethereum launched in July 2015 did the financial revolution truly begin.

As a generalist, programmable blockchain, Ethereum, made it possible to recreate the financial infrastructure — exchanges, market makers, lending, borrowing, and banking. These automated smart contracts became known as DeFi protocols, running on the Ethereum blockchain.

DODO is a new DeFi protocol that brings more innovation into an already ingenious ecosystem. Find out below what makes it stand out.

What Is DODO?

DODO fulfills the same role as Ethereum’s biggest decentralized exchange — the Uniswap exchange. However, DODO is not only a decentralized exchange (DEX) hosted on Ethereum, but also on Binance Smart Chain. Furthermore, it has a new approach to making a DEX run efficiently. While Uniswap relies on automated market makers (AMMs), DODO introduces innovation in the form of a proactive market maker (PMM) algorithm.

PMM is the main distinguishing factor that most say will define DODO as a crypto project. Let’s break down the difference between AMM and PMM to understand what DODO brings to the DeFi table. As you may know, an AMM’s role is to provide liquidity into the crypto space without the need for central mediators. However, there is a problem with AMMs that yield farmers often encounter, relating to how liquidity is allocated.

For instance, if you use Uniswap’s AMM to spread the crypto assets along the entire price range, only those funds nearest to the market price will end up being utilized. In turn, as the rest of the funds are idling, this creates higher slippage and capital inefficiency.

While capital inefficiency is self-explanatory, slippage occurs when trading parties settle for a price that diverges from the price they initially requested (i.e. between the period when they entered the market and executed the trade). DODO’s PMM tries to fix this problem of slippage and capital inefficiency by mimicking the behavior of centralized exchanges.

In other words, DODO’s PMM actively shifts buy and sell orders, aligning with the current market price. Its PMM algorithm accomplishes this with the help of oracles — third-party services that bring real-world data to smart contracts. Therefore, because PMM creates a flatter liquidity curve, yield farmers can take advantage of lower slippage.

In charge of aggregating liquidity sources is DODO’s SmartTrade platform. It compares these sources to set an optimal price for trading token pairs. Likewise, DODO enables investors to customize fees, crypto ratios, and liquidity depths.

Who Is Behind DODO?

DODO is a newcomer in the DeFi scene, having launched in August 2020. The platform’s core developers and founders are pseudonymous Radar Bear and Diane Dai, while the rest of the Chinese development team remains anonymous.

In August 2020, DODO received $600,000 in seed funding via Framework Ventures. A month later, in September 2020, DODO procured a much larger funding round worth $5 million, courtesy of Binance Labs, Pantera Capital, and Three Arrows Capital. In the follow-up private sales, DODO’s appeal was also irresistible for major players in the crypto scene, such as Coinbase Ventures, Alameda Research, Galaxy Digital, and CMS Holdings.

DODO Crypto Project In Numbers

The DODO coin is DODO’s native ERC-20 token used for governing the protocol. DODO token holders can use the coin to either create or vote on proposals to improve the network. They can also receive trading fee rebates and rewards whenever they stake the tokens in liquidity pools.

DODO’s SmartTrade trading platform also allows for Crowdpooling and Initial DEX Offerings (IDOs). This is another way for the token’s stakeholders to take part in IDO campaigns. On another note, Crowdpooling aims to resolve a critical problem plaguing DEXs — frontrunning — the illicit practice of getting in front of public trades before the asset’s price goes up or down. By facilitating equal distribution of tokens to supply liquidity, Crowdpooling reduces the issue of frontrunning bots.

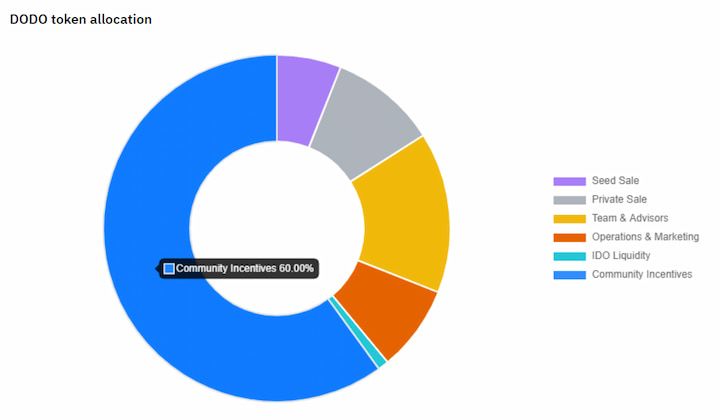

The total supply of DODO tokens is 1 billion, out of which 110.5 million are in circulation. DODO team devised a scheduled release of coins up until April 2025. You can see its distribution on the chart below.

Besides 60% of DODO tokens poured into community incentives, other categories form as follows:

- IDO Liquidity – 1%

- Seed Sale – 6%

- Operations & Marketing – 8%

- Private Sale – 10%

- Team & Advisors 15%

Although DODO’s protocol was audited by PeckShield blockchain security firm, it did suffer some attacks. One of the biggest ones was in March, with $3.8 million worth of DODO tokens stolen. It seems that the exploiter was able to successfully deploy a frontrunning bot, as detailed on DODO’s official statement about the incident. However, despite the security breach, DODO’s price barely budged by 2%.

DODO Coin Price

DODO token saw its ATH (all-time-high) price on February 21, 2021, peaking at $8.25. After the hack in March, the DODO token was undaunted, continuing to rise in price until the historic crypto crash in May.

Between May and the present, the DODO token stabilized at around $1.4 with an upward trajectory. Any crypto wallet with a built-in DEX browser will allow you to buy and trade in DODO tokens. As of this writing, the token's market cap sits at about $180 million, ranking as the 51st largest DeFi protocol on defipulse.com with $78.9 million staked tokens.

Conclusion

Whether DODO is worth buying is another matter. After Uniswap underwent its V3 upgrade, it improved both capital efficiency and customization of fees for yield farming, to name just a few improvements. However, while DODO’s PMM approach is promising, it did suffer the very exploit it tried to prevent — frontrunning.

On the other hand, it is difficult to name a DeFi protocol that wasn’t exploited or in some manner. In this light, given DODO’s low price that is in January’s range, and the rise in its TVL (total value locked), it may be worthwhile diversifying your DeFi portfolio to take advantage of the potential growth spurt later on.

DODO Available on Komodo Wallet

Komodo Wallet is a non-custodial wallet, crypto bridge, and peer-to-peer (P2P) decentralized exchange that provides native support for the DODO coin.

Users can HODL and trade DODO on Komodo Wallet along with other popular cryptocurrencies such as BTC, ETH, DOGE, MATIC, and much more.