Bitcoin mining, the backbone of the cryptocurrency ecosystem, is intrinsically tied to the issuance of new Bitcoins.

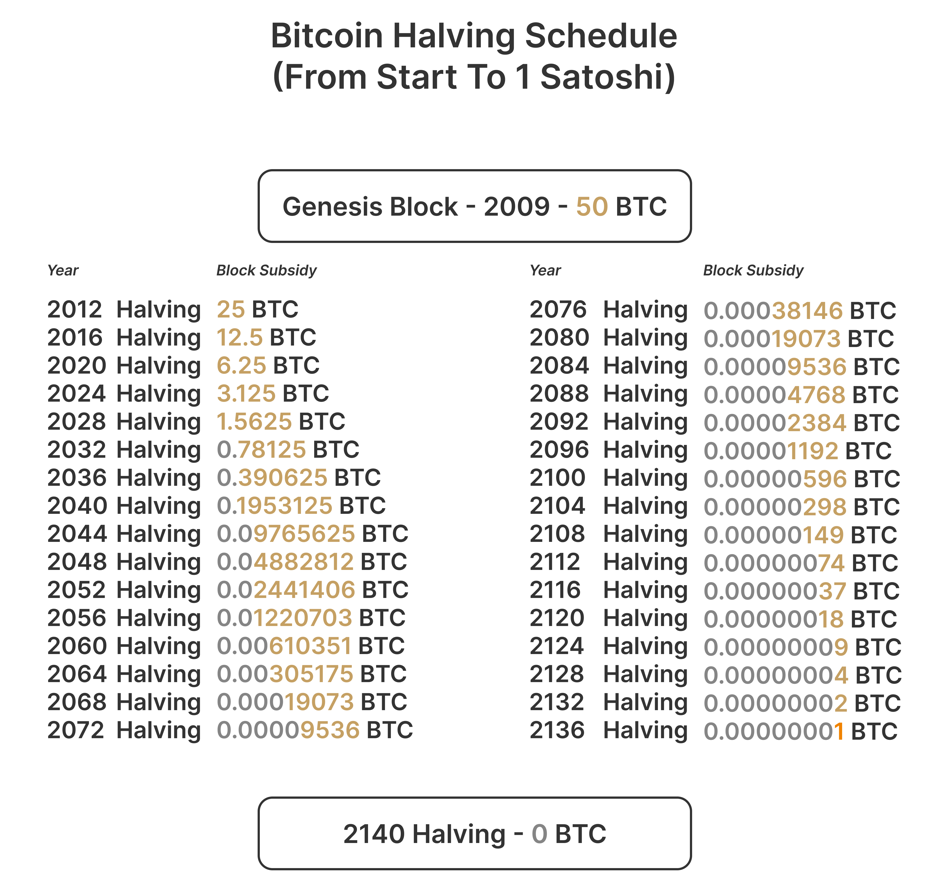

With a fixed supply limit of 21 million bitcoins, understanding the implications of reaching this milestone is crucial. It is estimated that all bitcoins will be mined by the year 2140.

Unveiling the Mechanics: Understanding Bitcoin Mining

Bitcoin mining involves solving complex mathematical puzzles to validate transactions and create new blocks.

This process rewards miners with newly minted Bitcoins, with the issuance rate halving approximately every four years. As the supply approaches its limit, miners face diminishing returns, reshaping the dynamics of the mining landscape.

Beyond Mining: Navigating the Post-Mining Landscape of Bitcoin

Once all bitcoins are mined, the Bitcoin network will undergo significant changes. Speculation abounds regarding the network's resilience and the potential shifts in miner incentives.

Alternative revenue streams, such as transaction fees, will become increasingly important in sustaining the network's security and functionality.

Speculation on the Implications for the Bitcoin Network

With no new Bitcoins being created, the Bitcoin network may experience a shift in its incentive structure. Miners, who were previously rewarded with newly minted coins, will need to rely solely on transaction fees for revenue.

This could lead to changes in the competitive landscape of mining and potentially impact the security of the network.

Examination of Potential Shifts in Miner Incentives

The transition to a post-mining era may prompt miners to prioritize transaction validation over block rewards.

This shift could influence miner behavior and strategies, potentially affecting the decentralization and security of the network.

Exploration of Alternative Revenue Streams

As mining rewards diminish, miners may explore alternative revenue streams to sustain their operations.

Transaction fees, which are collected for processing transactions on the network, will become increasingly important.

Miners may also offer additional services or participate in other blockchain-related activities to generate revenue.

Bitcoin Deflationary Concerns and Economic Impact

The fixed supply of Bitcoins raises concerns about deflation and its potential economic ramifications.

The Impact of Limited Supply

A finite supply of Bitcoins contrasts with traditional fiat currencies, which can be subject to inflationary pressures.

This scarcity is seen as a fundamental aspect of Bitcoin's value proposition.

Scarcity and Value

Bitcoin's limited supply contributes to its perceived value as a store of value and hedge against inflation.

However, concerns about deflationary pressures and hoarding behavior persist.

Economic Effects

The transition to a post-mining era may impact Bitcoin's economic landscape, influencing factors such as price stability, adoption, and macroeconomic policies.

Deflationary pressures could incentivize saving over spending, potentially impacting consumer behavior and economic growth.

The Future of Bitcoin

As Bitcoin evolves, technological advancements will play a pivotal role in shaping its future trajectory.

Exploration of Technological Advancements

Scalability solutions, such as the Lightning Network and sidechains, aim to address Bitcoin's throughput limitations and enhance its utility as a medium of exchange.

These innovations could play a crucial role in sustaining Bitcoin's relevance and adoption in a post-mining era.

Consideration of Protocol Changes

The post-mining era may prompt discussions about potential changes to the Bitcoin protocol. Adaptations may be necessary to ensure network security, decentralization, and sustainability.

This could involve updates to consensus mechanisms, governance structures, or incentive models.

Final Thoughts on Bitcoin

As Bitcoin approaches its supply limit, the cryptocurrency community faces both challenges and opportunities. Navigating the post-mining landscape requires foresight, innovation, and collaboration.

Despite the uncertainties, Bitcoin's resilience and adaptability continue to inspire confidence in its long-term viability as a transformative financial technology.

The journey beyond mining marks a new chapter in Bitcoin's evolution, one that promises to redefine the future of finance and reshape the global economic landscape.

HODL and Trade BTC with Komodo Wallet

Komodo Wallet is a non-custodial wallet, decentralized exchange, and crypto bridge that supports Bitcoin, Ethereum, Litecoin, Dogecoin, and numerous other cryptocurrencies.