In 2020, the adoption of decentralized exchanges (DEXs) ramped up significantly. The DEX landscape is quickly evolving in 2021. While DEXs today mainly limit trading to a single blockchain network, the future of cross-protocol trading is looking bright.

Why Use A Decentralized Exchange?

Before we look at how the DEX space has evolved, it's important to answer the question, "Why use a decentralized exchange?" After all, centralized exchanges like Coinbase, Huobi, Binance, Kraken, and others are quite established with large user bases. Although many of these options offer a great user experience, there are a few general reasons why traders are now beginning to favor decentralized exchanges over centralized exchanges.

Liquidity Pool (LP) Incentives

Decentralized exchanges have made it easy for crypto hodlers with idle funds to make an APR. Although providing liquidity is risky due to rug pulls on AMM-based DEXs, the potential profits are enticing. Plus, we are beginning to see new types of DEX liquidity that adds a greater degree of security for liquidity providers. Centralized exchanges don't offer these incentives, making them more favorable for risk-averse people but less favorable for people who are willing to take risk it for the biscuit.

Your Keys, Your Coins

With decentralized exchanges, you trade from your own non-custodial wallet. Once the trade is completed on a decentralized exchange, you don't have to worry about whether someone else is keeping your funds secure. You - the hodler - now have control over your actual funds - not an IOU. In comparison, centralized exchanges and even banks have suffered from security breaches on several occasions - resulting in losses of funds for users. Even though you can withdraw assets from most centralized exchanges into your personal wallet, there are often wait times or maintenance windows where withdrawals are disabled. Some centralized trading platforms charge high fees for withdrawals, which tends to discourage withdrawals of small amounts of crypto.

Trade New & Undiscovered Coins

Want to be able to trade a new crypto asset? In many cases, it takes months or years to get listed on centralized exchanges. With decentralized exchanges, it's possible to instantly list any new crypto asset, especially assets that can be created fairly easily (e.g. ERC-20 tokens). DEXs not only open up participation in initial DEX offerings (IDOs) for new new assets but also provide easy access to liquid markets via liquidity pools.

ERC-20 DEXs

Based on the headlines it might appear that the DEX industry revolves around Uniswap. While the combined trading volume of other ERC-20 DEXs pales in comparison, the reality is that the entire DEX industry is evolving, with other major players starting to gain ground. Sushiswap exchange and 0x are two examples of ERC-20 DEXs that are gaining momentum. Despite high gas fees for Layer 1 transactions due to congestion on the Ethereum blockchain network, ERC-20 DEXs are still popular for cryptocurrency trading. Loopring - a Layer 2 protocol - provides a solution for much cheaper, faster DEX trading on the Ethereum blockchain network. Later in 2021, the proposed EIP-1559 will likely be implemented, which will significantly reduce gas fees for Layer 1 ERC-20 DEXs. This move would make it more economical to use ERC-20 DEXs for smaller trades, which in turn could noticeably boost trade volumes and even lead to the rise of more Uniswap clones.

BEP-20 DEXs

Binance has emerged as an up-and-coming DeFi ecosystem that could soon rival Ethereum. Binance Smart Chain has become a more scalable option that fills a gap in the market mostly generated by Ethereum's slow response to tackling high gas fees. Included in the various Binance ecosystem applications are a few notable BEP-20 DEXs. Similar to ERC-20 DEXs, BEP-20 DEXs are solely focused on supporting trading of tokens built on Binance Smart Chain. PancakeSwap, BakerySwap, and BurgerSwap are popular examples. As of March 2021, PancakeSwap has actually surpassed 24-hour trading volume of Uniswap. BEP-20 DEXs appear to be trending up. Compard to ERC-20 DEXs, they have a similar UI/UX and also offer yield farming support. More importantly, gas fees are much lower - making small trades more feasible.

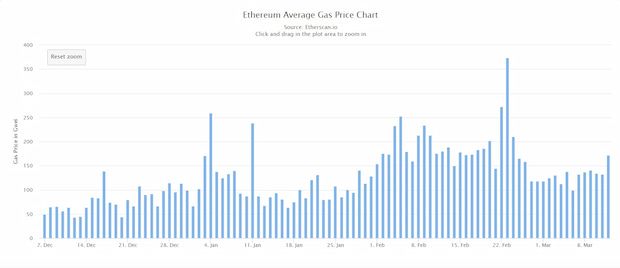

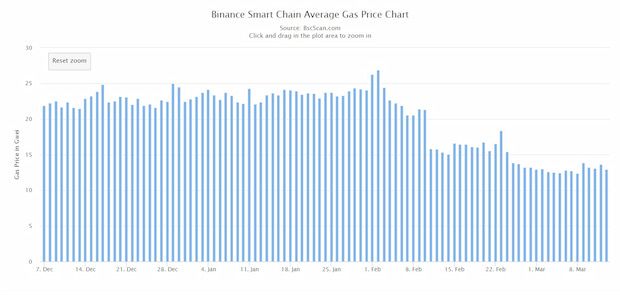

Ethereum Vs. BSC - Comparing Gas Prices

While gas fees can vary quite a bit, even from minute to minute, it's easy to see how Ethereum and Binance Smart Chain compare over a longer period of time. From the charts below, one thing stands out: the day with the lowest gas price for Ethereum transactions is higher than the day with the highest gas price for Binance Smart Chain transactions. In terms of gas fees, Binance Smart Chain has a clear advantage. Traders also need to pay platform fees for using the DEXs. Comparing the top ERC-20 DEX (Uniswap) charges 0.3% per trade, and the top BEP-20 DEX (PancakeSwap) charges 0.2%, giving Binance Smart Chain another advantage.

Atomic Swap DEXs

Cross-Protocol DEX Trading

So we've looked at a few reasons why people are using decentralized exchanges as well as specific examples of ERC-20 DEXs and BEP-20 DEXs. One thing you may have noticed is that the examples above show what it's like trading assets on a single chain. But what about if you want to trade an ERC-20 token for a BEP-20 token? Or what about all the other crypto assets that exist on their own blockchain protocols? This is the point where the above DEX solutions can't help you. Sure, you can use a centralized exchange as an alternative - but there's actually a decentralized way to trade across blockchain protocols. Atomic swaps are the answer. Swaps are called "atomic" because either the trade is successfully completed and each trader receives the other one's funds, or nothing happens and both traders simply keep the funds they started with. Atomic swaps are made wallet-to-wallet, in a fully peer-to-peer manner.

Origins of The Technology

Compared to other DEX technologies, atomic swaps have been around for a long time. The first atomic swaps took place in 2014. So why is no one talking about atomic swaps - at least as of early/mid 2021? Like many other technologies, atomic swaps solve a highly complex problem - blockchain interoperability. For several years, atomic swap technology was considered to be a frontier technology. But in 2021 the technology is now at a point where it's capable of supporting a new wave of DEX applications. In the span of around three years, atomic swaps have gone from requiring a deep understanding of the command-line interface to now being accessible on GUI applications for mobile and desktop devices.

Where The Technology Is Going

When it comes to blockchain interoperability, the sky is the limit for atomic swap-powered DEXs. 99% of cryptocurrencies in existence are compatible with atomic swaps. Komodo's developer team is continuously integrating new blockchain protocols, with dozens (e.g. Bitcoin, Ethereum, Litecoin, and Komodo) already supported. In other words, users can trade BTC for ETH or LTC for KMD without having to use a centralized trading platform.

There are a few different atomic swap DEXs currently focused on bringing this technology to the masses. Liquality, JellySwap, and Switcheo are a few examples. However, Komodo is currently leading the way in this category of DEX technology — in terms of the number of active users, trade volume, and supported blockchain networks.

Komodo Wallet as well as all DEXs that use Komodo's atomic swap DEX technology share a unified liquidity pool and decentralized P2P order book system – making it easy for traders to make atomic swaps regardless of which application they use.

vity might be less prominent, negatively affecting the SUSHI coin price.