If you've ventured into investments, whether in cryptocurrencies or the stock market, you're likely familiar with the maker vs. taker dichotomy. These concepts bear significance for those involved in trading, making it essential for every investor to comprehend these foundational principles.

The significance of maker vs. taker within the realm of crypto investing is substantial. Grasping the benefits and associated fees holds paramount importance. This comprehensive manual aims to tackle these inquiries, shedding light on the distinctions and roles of both participants in the market. Be assured, the intricacies of the topic are less intimidating than they may seem, as we'll illustrate shortly.

In the realm of cryptocurrencies, the dynamics of "maker vs taker" roles play a pivotal role in maintaining a smoothly functioning trading environment.

| Makers | Takers |

|---|---|

| Initiates Trade | Accepts Trade |

| Sets Market Price | Agrees on Market Price |

| Typically pays a lower trading fee | Typically pays a higher trading fee |

| May have to wait for order to complete | Order completes nearly instantly |

Key Takeaways

- Understanding Roles: Makers initiate orders, adding liquidity to the market, while takers execute these orders, consuming liquidity.

- Impact on Trading Fees: Makers often benefit from reduced fees due to their role in enhancing market liquidity, while takers may face higher fees because their actions reduce liquidity.

- Liquidity and Market Stability: The maker vs. taker dynamic is crucial for maintaining market liquidity and stability. A well-balanced relationship between the two ensures smoother trading experiences and helps prevent market manipulation.

- Practical Application: Whether you are a maker or a taker depends on your trading strategies and goals. Knowing the difference is essential for optimizing your trading outcomes, especially in terms of fees and liquidity management.

Makers Vs. Takers

The Definition of Market Makers

A "maker" assumes the responsibility of initiating either a purchase or a sale order, whereas a "taker" promptly acts as the entity executing that very order. In the realm of trading, the dynamics of "maker vs taker" are pivotal. Market makers operate by setting a spread between the buy and sell prices of an asset.

The Definition of Market Takers

When a taker engages, they pay the asking price, which typically surpasses the market price. Subsequently, the trade is executed based on the bid price. The discrepancy between the market price and the bid-ask price constitutes the spread, signifying the profit captured by the market maker.

Maintaining Market Liquidity

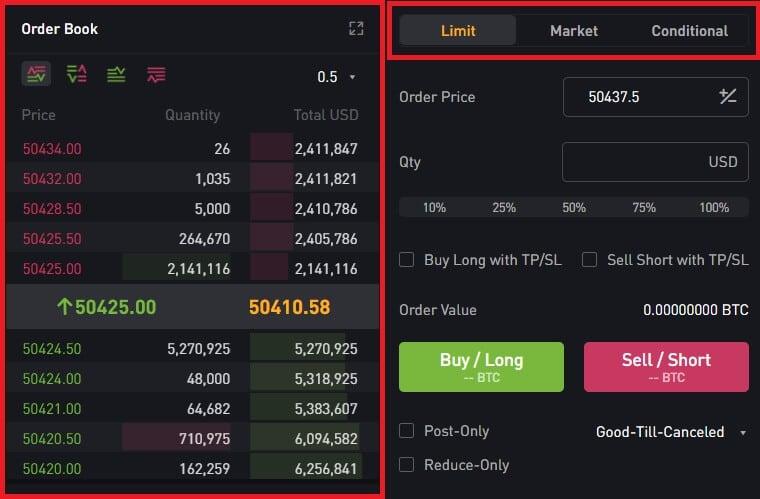

Another angle to view this is that makers and takers play distinct roles in shaping the order books. Their pivotal responsibilities revolve around maintaining market liquidity.

The financial gains of makers and takers hinge on the spread between the bid and ask prices of assets, as they manage the risk associated with asset ownership even when their value might experience fluctuations.

Makers and takers employ a plethora of strategies to seek out profits, often considering market signals specific to their roles. Nevertheless, opinions on the effectiveness of these strategies can vary, with some viewing them as bordering on the mystical rather than the practical.

The Role of Makers and Takers on Crypto Exchanges

A "maker vs taker" dynamic is pivotal in upholding price feeds and quotes for a given asset. Essentially, specialized market participants known as makers contribute to bolstering liquidity for a specific asset, thereby enabling seamless transactions for both buyers and sellers of the asset.

Becoming a market maker is a relatively straightforward process. By submitting a limit order on a centralized cryptocurrency exchange like Binance or a peer-to-peer decentralized exchanges (DEX) like Komodo Wallet, you actively participate as a market maker.

Additionally, other DEXs like Uniswap use a solution called automated market makers (AMMs) to connect makers and takers.

Trading Fees and Liquidity

The maker vs. taker dynamic is crucial when discussing trading fees. Both market makers and takers face charges on trading platforms. However, market makers enjoy reduced fees owing to their pivotal role in enhancing liquidity. On the contrary, market takers encounter escalated fees due to their actions impacting liquidity.

Fee Structures for Makers and Takers

Nonetheless, it's vital to recognize that this fee arrangement can differ based on the exchange. Some exchanges might even waive fees for market makers to incentivize liquidity provision, acknowledging its vital role in upholding the exchange's operational efficiency.

For a deeper understanding of how crypto trading fees work and to explore the platforms offering the lowest crypto fees, check out our detailed guide.

The Relationship Between Liquidity and Trading Fees

As previously mentioned, the interplay of market makers and takers profoundly influences the continuity of asset liquidity. This factor is crucial in maintaining a stable, if not controlled, price for an asset.

The absence of liquidity translates to an inability to buy or sell an asset, thereby detrimentally impacting its valuation. Additionally, market makers and takers contribute to safeguarding the asset from susceptibility to market manipulation—albeit to a certain extent.

Maker vs. Taker — Which One Are You?

We trust you've comprehended the distinctions between market makers and market takers outlined in this guide.

Understanding the 'maker vs taker' model is essential for gaining insights into liquidity and trading dynamics, which directly impact price fluctuations.

This model serves as a fundamental framework across various market segments and asset classes, making it a valuable concept to grasp.

Identifying Your Trading Style

Understanding the difference between being a market maker or a market taker is crucial. Market makers thrive on setting limit orders, patiently awaiting profitable trades by providing liquidity, which often results in lower fees. This approach suits traders who prefer a steady, strategic involvement in the market, focusing on long-term gains.

On the other hand, market takers favor immediacy, executing orders at the best available price. This style is ideal for those who prioritize speed and certainty in their trades, even at the cost of higher fees. Your trading style will depend on whether you value control over price and patience or prefer swift execution and immediate market participation.

The Advantages and Disadvantages of Each Role

Market makers benefit from lower trading fees and the ability to profit from the spread between buy and sell prices, but they face the challenge of managing the risk associated with holding assets that might fluctuate in value.

In contrast, market takers can execute trades immediately at market prices, providing speed and certainty, but they often incur higher fees and have less control over the price at which their orders are filled.

HODL and Trade Crypto with Komodo Wallet

Komodo Wallet is a non-custodial wallet, decentralized exchange, and crypto bridge that supports popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Dogecoin, and more.

Market takers pay roughly 0.13% in trading fees, while market takers pay zero fees.

FAQ

How Do Market Makers Profit?

Market makers profit from the spread between the buy and sell prices of assets.

What is the Risk for Market Takers?

Market takers risk paying higher fees and potentially getting less favorable prices due to market fluctuations.

Can You Be Both a Market Maker and a Market Taker?

Yes, depending on your trading strategy, you can act as both a market maker and a market taker at different times.

Why Do Market Makers Get Paid More in Rebate Structures

Market makers receive higher rebates because they provide liquidity, which is essential for a healthy trading environment.

How Do Market Makers Affect Price Stability?

Market makers enhance price stability by maintaining liquidity, reducing the likelihood of extreme price swings.