In this blog post, we look at the reasons why national currencies have experienced hyperinflation throughout the 20th and 21st centuries and possible solutions that could lead to economic stabilization.

What Is Hyperinflation?

Inflation occurs when a currency is devalued and its purchasing power becomes worth less over time. The cost of products and services are raised, affecting living standards and potentially leading a nation into poverty as is illustrated many times in history. Today inflation is controlled by central banks that manage the value of fiat currencies by adjusting inflation in accordance with internal policies. Hyperinflation is a situation where the devaluation of currency is excessive and uncontrollable. The direct cause of hyperinflation is an accelerated increase in the supply of money to meet certain demands. It could also be excessive growth of money supplied to a single economy through money printing enforced by central banks or governments

For the majority of the 20th century, most nations adhered to the gold standard. This was an international standard maintained mainly for foreign exchange purposes. All currencies were backed by precious metals and as a result, were commodity currencies. Some important dates in history mark pivotal moments that highlight the most significant events as they relate to the devaluation of national currencies. This leads to the ultimate price of hyperinflation. The most significant of all contributors include Germany, England, and the United States of America.

1023 and The First Paper Currency

The first emergence of paper money, also called notes, began in China. Only at the time money was not issued by banks at all, the notes were printed by private merchants. Although the government, known as the Song dynasty, was not the sole issuer of paper money, it created a monopoly via a national currency called the Jiaozi and became the sole issuer of this currency.

1919 and The Prohibition of the Gold Standard

In 1919, the German Mark was the national currency of Germany. At the time, it was trading at 6.7 to 1 USD. It was the end of World War I and the German economy had suffered tremendously. The war negatively impacted Germany, and there were many reparations to pay, mostly in foreign currency. There was a global standard of measurement against a fixed price of gold. The first gold price had been set by Sir Isaac Newton in 1717 and exactly 200 years later gold traders Rothschild & Sons, Mocatta & Goldsmid, Pixley & Abell, Samuel Montagu & Co fixed the price on September 12, 1717 at $19.39. Despite its reparation obligations, Germany maintained its international agreements and adherence to the gold standard.

There was no shortage of gold in the world. South Africa produced an abundance of gold followed by Zimbabwe and Ghana. Almost all was imported to London and sold on London markets. However, in the same year, the bank of England prevented the import and exportation of gold. This is the first significant interference of a bank to manipulate the value of its national currency. The Bank of England was able to affect the dollar exchange rate against the pound sterling. The other outcome was the access to credit without a counterparty. Because the world has a standard rate of exchange, gold needed to be suspended and international agreements forgotten in order to achieve this.

1923 and Hyperinflation In Germany

It’s 1923 and in order to meet its reparation demands, Germany’s Weimar government has taken out loans in USD and printed money excessively to make payments in foreign currency. One banknote is printed with a value of 100 trillion, and valued at a ratio of 1 to 1 trillion to its value prior to the war. The German mark can no longer be traded on international markets. Because the mark is worth less, more money needs to be printed. This the cycle of an ever increasing supply of money that caused the worst case of hyperinflation in history.

Germany attempted to remedy this by preventing foreign exchange. Prior to WWI, the Rentenbank had German marks pegged to gold. It was abandoned due to the cessation of gold exports. Germany held no gold reserves. Despite popular belief, there was no gold - none hidden underground, in a castle, or in the sea. The Rentenbank maintained its commitment to the gold standard in an attempt to reverse hyperinflation, but they did this without any gold reserves. They pegged the mark to the price of gold despite not owning gold. This allowed the bank to reduce money printing by printing within a threshold to match supply and demand.

1929 and The Great Depression

In the USA, a recession hit right after the stock market collapsed in 1929. Because the USA maintained the gold standard, the effect is opposite to that of Germany. The supply of money remained constant and the effect was deflationary; however, debt accumulated. Meanwhile, in Germany, there were ongoing massive protests due to widespread hunger and unemployed people which led to the formation of a movement called the Reich Committee. This is the year that would become known as The Great Depression.

The Great Depression was actually a series of isolated events. In retrospect, these events only seem related in that they result from money policies by banks not considering established international agreements. Central bank policies were used to manipulate exchange rates, manipulate the value of national currency, abuse credit, and print money to increase circulating supply. Banks abandoned the international gold standard in order to achieve this.

The banks saw the gold standard as restrictive, as a straitjacket principle that predetermined the circulating supply of money. The supply of money remained fixed and its price stable which limited the freedom of banks to print money. There was also a desire by private banks to abandon gold. Central banks developed negative sentiments towards gold even going as far as to associate gold with religious ardor.

1933 and Bank Runs

It's 1933 - the height of the Great Depression. Nations begin abandoning the gold standard in order to print more money to improve economies. The most significant event is the first 'bank run' in England and in the USA. Inflation was high in England and the pound was being devalued. People experienced fear, uncertainty, and doubt. They rush to withdraw their funds. The Bank of England decided to raise bank rates in order to prevent mass withdrawals and prevent the collapse of banks. The fear of banks was that further instability would result from the closure of banks. In order to allow banks to operate, the Bank of England resorts to further debt services to prevent raising rates even further.

In the USA, the United States dollar is also devalued. As a result, three bank runs occurred in four years. The USA had to close down 9,000 banks by March 4, 1933. The election of 1932 revolved around the voters and candidates’ sentiments towards banks. Franklin D. Roosevelt was elected president with a clear objective to abandon the gold standard. Roosevelt allowed the USD/gold peg only for foreign exchange purposes. Gold ownership was banned and no longer regarded as legal tender.

The New Deal was implemented in his first 100 days in office. This plan was used to bring economic recovery for the USA, with the passage of legislation like the Banking Act of 1933. Roosevelt declared a holiday for banks (bank holiday) on March 6, 1933, to prevent bank runs and allow for a recovery plan to take root. Roosevelt saved 1,000 banks from closing down. Today banks apply a principle called fractional reserve banking. This allows financial assets to be held in central banks with only a fraction of cash available at private banks.

1944 and The Nixon Shock

The US dollar (USD) was pegged to gold until 1971. That all changed with “the Nixon shock.” The Nixon shock is the moment in history when the US dollar officially became a fiat currency. The US dollar would not be traded for gold and would no longer be backed by any asset. The US applied a quasi-gold standard where gold is only used as a security for central banks to settle international payments in foreign currency. All national currencies were pegged to USD, and USD was pegged to gold at a fixed rate until the year 1973. After 1973, USD became the new monetary standard for the world. As fiat currency, USD is not tradeable for any assets or redeemable for any precious metal in global trade.

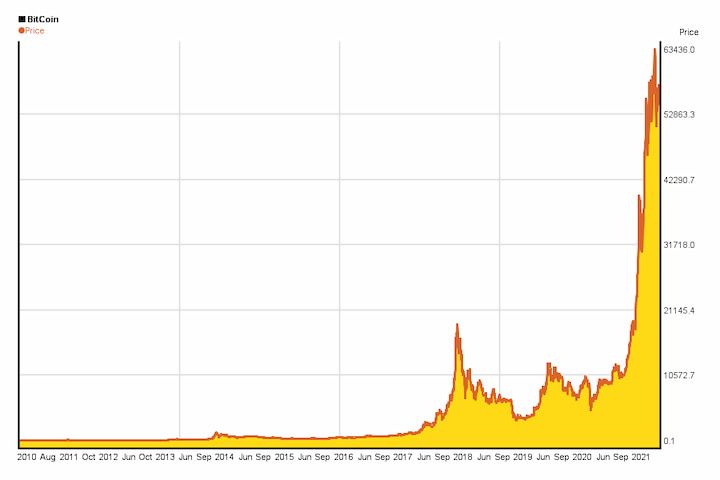

Since 2019 $9 trillion dollars has been printed to circulate in the US economy, with 22% of the total USD supply printed in 2020 alone. In 2021, the Biden administration introduced a $1.9 trillion stimulus bill by printing money and furthermore has another $6 trillion proposal for 2022. Money printing is increased to provide stimulus in the economy. The cost of this is a devalued currency and ever increasing debt to the point of irreversibility. The historical Bitcoin chart shows a strikingly similar trend to the dollar’s historical printing trend. It is as if Bitcoin responds to hyperinflation of USD. The chart possibly even represents a potential new gold standard in the making.

History Repeats Itself?

The decision to readjust the German mark to the gold standard was made in one day. In exactly one year, the mark’s hyperinflation was completely reversed. It reached the same value it had maintained prior to WWI. It is especially interesting to note that Germany had no gold physical reserves yet applied the principle of a fixed supply to reach a very stable and sustainable national currency. Today gold has the status of fiat currency due to the financialization of gold - paper gold that is not necessarily redeemable for gold. The application of a gold standard is still possible without the physical commodity, therefore even cryptocurrency can act as a standard against which any other currency can be traded much like how cryptocurrency markets function today.

📧Komodo Newsletter

If you'd like to learn more about blockchain technology and keep up with Komodo's progress, subscribe to our newsletter. Begin your blockchain journey with Komodo today.