For novice traders, cryptocurrency trading signals provide a guided path into the trading world, with experienced industry experts (and the occasional grifter) using their knowledge to collectively benefit their followers.

Signal providers can offer a variety of data points for their community to utilize, such as which cryptocurrencies offer good investment opportunities, what price to buy the asset, the targeted profit levels to sell, and maybe most importantly of all, the stop loss a trader should set to protect against downside risk. These metrics are usually determined through extensive and in-depth technical and financial research, with the best crypto signals providing their communities fantastic returns.

What are Crypto Signals?

When breaking down the essence of cryptocurrency trading signals, they are essential copy trading instructions for others to follow that make it easier to manage your crypto. This is why it is so important to do major due diligence before taking a signal provider's advice, as you are trusting your money based on their decisions. As noted above, providers of cryptocurrency signals usually offer four points of information to their followers:

Which cryptocurrency to target - This signal information will determine which cryptocurrency the provider has their eyes on, such as BTC, ETH, or KMD.

Targeted buy prices - This signal will provide the price range for a trader to get in on the latest signal. It tends to be slightly lower than the market price but can vary based on current market dynamics. By providing a range of prices instead of a definitive entry point, users have more leeway for involvement.

Targeted sell prices - These are the 'take profit' areas, or the different price levels traders should identify as targets. This usually includes multiple options for users to maximize their potential profits while limiting downside risk if the targeted sell price doesn't hold.

Proper stop losses - New traders sometimes do not understand the true importance of a well-thought-out stop loss, as this is the ultimate way to protect against downside risk in an extremely volatile market. This target offers a buffer for the safety of your asset's value.

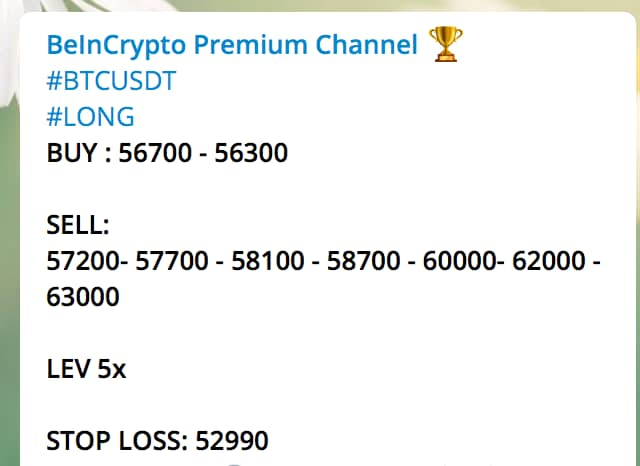

Let's go over an example from the BeInCrypto Premium Channel, a paid signals group. In this case, the signaler is pointing to a BTC long, meaning he thinks Bitcoin will go up in price. He offers a targeted buy price range between $56,300 - $56,700, as well as different targeted sell levels to lock in profits. Finally, he offers a stop loss at the price of $52,990 if his intuition is incorrect and the trade doesn't pan out.

How Do I Receive Crypto Signals?

There are different tiers of crypto signal groups depending on what the user is looking for, but in general, crypto signal communities are hosted on Telegram, the encrypted messaging app. Since most cryptocurrency users end up utilizing Telegram to stay active in cryptocurrency communities, many of the best crypto trading signals can be found on various Telegram groups. Also, Telegram offers a unique suite of features not normally available to mobile messaging apps, mainly the introduction of automated bots. These bots have huge benefits for signal receivers, as they offer the ability to automatically execute a trade based on a given signal. With the right bot pre-programming and a live account on a cryptocurrency exchange, trades can be seamlessly executed with minimal user inputs.

If you do not have Telegram or do not want to sign up, the second most popular platform to receive cryptocurrency trading signals is through email. Besides being technically easier to operate with, this method has drawbacks as it can be harder to exactly time the entrance of a signal if you are not constantly updating your email inbox. On Telegram, users instantly receive a notification when a signal is distributed; via email, it can be much harder to instantly interact.

Different Crypto Signal Providers: Free Vs. Paid Groups

There are generally two options for a signals group, free groups or paid groups, with each iteration providing different perks and benefits. Obviously, with a free signals group, you do not have to pay for group admittance, but you may not be dealing with a true expert. Although, just because a group is free doesn't mean it is amateurish; you could very well be receiving signals from top traders. In general, free cryptocurrency trading, signal groups are much larger than their private counterparts and can sometimes be a sales funnel to convert the signal consumer to a paying member.

If you determine that the signals are trustworthy and well researched, you can pay to receive signals from a premium signals group. Since customers need to pay to gain access, there is a lot more pressure on the signal provider to be successful, otherwise, group members will no longer find value in paying for these signals. Users are typically required to pay a monthly membership fee, which they can pay in a variety of cryptocurrencies (depending on the group) or with a credit or debit card.

Never before in #BTC's price history has BTC followed the Stock to Flow model so perfectly like it is doing now

— Rekt Capital (@rektcapital) March 16, 2021

But it is the upside price deviations from the S2F line that tend to precede Bull Market tops for $BTC

And #Bitcoin hasn't even deviated yethttps://t.co/Z1VR1o443t pic.twitter.com/IjGdKphzIB

Pros and Cons of Cryptocurrency Trading Signals

Now that you have a better idea of what cryptocurrency trading signals entail, let's break down some pros and cons of opting to receive them.

The Benefits

Anyone can start trading crypto with no prior experience - Crypto signals take the guesswork out of trading, offering up a cookie-cutter trading pattern for all to follow.

Crypto signal providers give regular updates, news stories, and technical analysis - This is an obvious benefit, as you have the ability to stay constantly up-to-date with all the latest events happening in the cryptocurrency world.

No research is required - In this guide, we view this characteristic as a pro and a con. From the beneficial side, you can successfully make trading profits without committing additional time to research.

It can be very profitable - If not, why would anyone want to join a cryptocurrency trading signals group?

Presents the opportunity to learn from experts - This is an extremely important characteristic. If you are in a crypto signals group, take advantage of all the knowledge flowing through the community. From the signal provider to other active members, crypto signal groups, present a great opportunity to expand your knowledge on trading strategies.

The Downsides

There are many upsides to receiving crypto trading signals, but there are some downsides as well.

You don't do your own research - All the wealth you have committed to the trades and the potential profits to be made are left up to someone else's research and assumptions, so choose wisely.

You rely on someone else for your profitability - This goes hand-in-hand with the con above; since you aren't knowledgeable or confident enough to make your own trading patterns, you must rely on someone else, which doesn't always turn out well.

Final Thoughts

All-in-all, cryptocurrency trading signals can be advantageous and profitable, contributing to their continued success as more users want to get involved in the cryptocurrency space. However, this does come with some risks, as you have to fully trust the signal provider is well-versed and has the community's best interest in mind. Although personal research is counterintuitive to the concept of crypto signals groups, it is the most important thing you can do before getting involved. Whether you are looking to make your first trade or simply looking to gain an additional edge, in-depth research is the key to finding and creating a successful long-term plan.

📧Komodo Newsletter

If you'd like to learn more about blockchain technology and keep up with Komodo's progress, subscribe to our newsletter. Begin your blockchain journey with Komodo today.