In this blog post, we cover the difference between centralized and decentralized exchanges - looking at the benefits and drawbacks of both.

Whether you’re using a centralized or decentralized exchange for cryptocurrency trading, understanding the basics of what they are and how they work is crucial before choosing a specific platform.

Key Takeaways

- Control and Custody: Centralized exchanges (CEXs) control users' private keys and funds, making them targets for hackers despite extensive security measures. Decentralized exchanges (DEXs) allow users to retain control of their funds through non-custodial wallets, but users must take personal responsibility for security.

- Security: CEXs, despite their security measures, are vulnerable to large-scale hacks due to the concentration of funds. DEXs avoid this risk but face vulnerabilities from smart contract bugs and insufficiently vetted projects. Users must secure their private keys to avoid individual attacks.

- Popularity and Usability: CEXs are more popular due to lower fees, ease of use, and cross-network trading. DEXs are gaining traction with platforms like Uniswap and PancakeSwap, offering incentives for liquidity providers and a growing user base.

- Fees and Costs: CEXs typically have lower trading fees and no gas fees for on-platform transactions, but may charge for withdrawals and deposits. DEXs' fees vary, heavily influenced by gas fees, with Layer 2 solutions offering lower costs.

- Speed and Regulation: CEXs offer instant trade execution, appealing to day traders. DEXs' transaction speeds depend on blockchain conditions, with slower processing during network congestion. CEXs face strict global regulations, while DEXs, though less regulated, are starting to implement KYC/AML checks.

What is a Centralized Exchange?

A centralized exchange (also known as a centralized cryptocurrency exchange or CEX) is a platform that enables users to trade, deposit, and withdraw cryptocurrencies.

Users interact with custodial wallets, meaning the exchange is mainly responsible for keeping funds secure. Examples of popular centralized exchanges include Binance, Huobi, Coinbase, Kraken, and FTX.

What is a Decentralized Exchange?

A decentralized exchange (also known as a decentralized cryptocurrency exchange or DEX) is a platform that enables users to trade cryptocurrencies. Users send and receive funds for trading directly from their own personal non-custodial wallets.

The user, not the exchange, is responsible for keeping funds secure. Examples of popular decentralized exchanges include Uniswap, PancakeSwap, 0x Protocol, KyberSwap, and Komodo Wallet.

Let's have a look at relevant discussions in the Quora community to understand what are the key differences between centralized and decentralized exchanges.

Summary - Decentralized vs Centralized Exchanges

Category 1 - Control

With a centralized exchange (CEX), the exchange operator owns your cryptocurrency private keys.

- This means you don't technically own your funds. Instead, the exchange enables you to trade your coins or withdraw them to an external cryptocurrency wallet.

- All the funds on the exchange are generally consolidated into a few high-value wallets. These wallets’ private keys are always under the control of the exchange, which makes them clear targets for hackers and bad actors. CEXs typically take extreme precautions to ensure user funds are safe, but even best security practices often aren't enough to stop large-scale hacks.

- While CEXs are custodial (meaning they hold user funds), DEXs are non-custodial (meaning they don't hold user funds).

- DEX users have control of their own cryptocurrency private keys and can move their funds freely without the permission of anyone through their own non-custodial wallets.

- Control also comes with risks, though. Users must keep their private keys secure at all times, because hackers often target individuals. Storing private key data as screenshots, digital documents, or emails is a bad idea for this reason.

- It's recommended that users use hardware wallets for large amounts and only write down sensitive data such as private keys or seed phrases on paper. Then, users need to store that information in a secure location.

Category 2 - Security

The security of centralized exchanges is difficult to assess across the board. Many centralized exchanges have never had a major security incident, while others have lost millions of dollars worth of user funds.

- Centralized exchanges hold the vast majority of user funds in cold wallets (offline hardware wallets), but hot wallets (online wallets) are still fairly vulnerable to attacks. Also, the user is still responsible for ensuring their funds are safe. For example, the user is responsible for securing their devices through two-factor authentication, strong passwords, and address whitelisting.

- Decentralized exchanges are secure from large-scale hacks compared to centralized exchanges, but there are plenty of risks to consider. For example, AMM-based DEXs may implement code that hasn't been audited or unknown bugs in smart contracts could make it easy for a hacker to drain user funds.

- Projects listed on many DEXs are also not always thoroughly vetted via security auditys, which makes rugpulls very common. So while users have control of their own funds, the nature of locking funds in smart contracts on many DEXs adds centralization - and creates security risks for DEXs.

- A more secure option is using a peer-to-peer, orderbook-based DEX since it doesn’t require “locking” of funds in smart contracts. To learn more about other blockchain-based applications, check out our guide on the decentralized finance definition.

Category 3 - Popularity

Just a few years ago, CEXs used to be the only option for cryptocurrency traders. DEXs were really complicated to use and lacked trading volume.

- Despite many improvements in DEX usability since then, centralized exchanges are still more popular by far. There are a few reasons to explain this.

- First, many CEXs offer lower trading fees. For example, if a user wants to trade ETH for DAI, or vice versa, CEXs don't require the user to pay gas fees (on-chain transaction fees) - which can be extremely high when the Ethereum blockchain is congested. Also, CEXs make it easy to trade assets from different blockchain networks.

- DEXs are becoming increasingly popular thanks in to the catalyst created by the success of the Uniswap exchange. The combination of incentives for market makers (liquidity providers) and unrestricted trading pairs has led to a surge in new users.

- When Ethereum became congested to the point where Uniswap and other ERC-20 DEXs became practically unusable for small trades, BEP-20 DEXs based on Binance Smart Chain (e.g. PancakeSwap) gained popularity.

- DEXs are becoming more mainstream as the technology behind them becomes more powerful. To understand more about how liquidity is supplied on various DEXs, check out our guide: DEX Liquidity Models Explained.

Category 4 - Fees

For trading fees, centralized exchanges generally have a standard fee structure that is either a flat rate no matter the trading amount or reduced fees the more you trade.

- For example, as of July 2021 Coinbase charges a taker fee of 0.50% for a total order size of $10k or less (within a one-month timespan) but only 0.18% for a total order size of $1m to $20m (within a one-month timespan), and even lower for higher amounts. Binance provides fee discounts for users that pay for fees in BNB. Most centralized exchanges charge fees for withdrawals to external wallets, while some even charge fees for deposits.

- Decentralized exchange trading fees can vary substantially depending on the blockchain protocol involved. For example, ERC-20 DEXs like Uniswap have much higher costs due to gas fees (at least prior to the launch of Ethereum 2.0).

- However, Layer 2 DEXs like Loopring are extremely affordable due to their ability to batch request many simultaneous off-chain settlements.

- Besides the major variable of gas fees, fees charged by the DEX platform itself are generally competitive with CEX platforms. Another benefit is you don't have to pay deposit or withdrawal fees when trading on a DEX.

Category 5 - Speed

Unless a centralized exchange has very low liquidity for a specific trading pair, market order trades are generally executed instantly.

- You will see the funds in your exchange wallet change to the traded asset practically instantly as well. This is why cryptocurrency day traders who frequently buy and sell cryptocurrencies often choose centralized exchanges.

- For decentralized exchanges, speed depends on how fast trades are executed by the blockchain network. Let's say you are trading Ethereum-based assets and decide you only want to pay very low gas fees. There's a chance that your trade may not be executed at all because other transactions on the network are prioritized by validators.

- If you're trading on a cross-chain DEX, you'll also have to consider that trade completion speed depends on the block times and potential congestion of the two networks you're trading between.

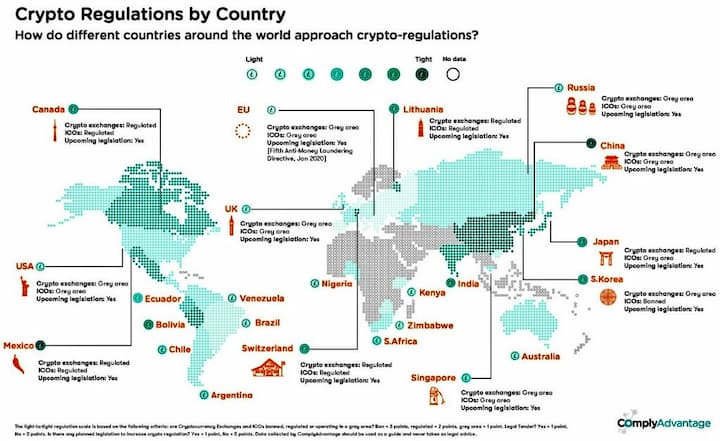

Category 6 - Regulation

If you look at the landscape of centralized exchanges, you'll notice that users in many countries have very few options to choose from.

- Even Coinbase, for example, as one of the leading exchanges in the world, doesn't have much of a presence in Latin America, Africa, or Asia as of July 2021.

- While there are other CEXs available in these regions, it's clear to see how difficult getting the proper licenses in various jurisdictions can be.

- For centralized exchanges, it's also more challenging from a regulatory perspective due to the fact that they are custodians - entities that hold user funds.

- Decentralized exchanges must also adhere to global regulations. The challenge is that regulations surrounding DEXs and other DeFi products are far less mature since the technology itself is newer.

- Some DEXs do require users to go through KYC/AML checks or have IP address bans in certain jurisdictions.

- Overall, for most users around the globe, however, DEXs are far more accessible than CEXs.

Conclusion

As you can tell from reading this article, there are many pros and cons to using a centralized exchange and a decentralized exchange. Although the top CEXs average $1 billion in daily trading volume, DEXs are gaining momentum - with several reaching $100 million daily.

As blockchain technology advances and crypto adoption increases, cryptocurrency exchanges will play an important role in global finance. As decentralized ledger technology (DLT) becomes more robust, the rivalry will only begin to heat up.

With the creation of DAOs, for example, a lot of people are starting to discuss the pros and cons of centralized vs decentralized organization structures. For now, CEXs and DEXs both offer users a way to get involved in the blockchain and crypto space.

FAQ

What are the main differences between centralized and decentralized exchanges?

- Centralized Exchanges (CEXs): Control users' private keys and funds, acting as custodians.

- Decentralized Exchanges (DEXs): Allow users to retain control of their private keys and funds, using non-custodial wallets.

Which type of exchange is more secure?

- CEXs: Vulnerable to large-scale hacks due to fund centralization, despite strong security measures.

- DEXs: Less prone to large-scale hacks but can be vulnerable to smart contract bugs and individual user errors.

Are there any risks associated with using centralized exchanges?

Yes, risks include potential large-scale hacks, security breaches, and loss of funds due to exchange control.

How do user experiences differ between centralized and decentralized exchanges?

- CEXs: Typically easier to use, offer lower fees, faster transactions, and cross-network trading.

- DEXs: Provide more user control over funds but can be slower, more complex, and subject to higher fees due to network congestion.

📧Komodo Newsletter

If you'd like to learn more about blockchain technology and keep up with Komodo's progress, subscribe to our newsletter. Begin your blockchain journey with Komodo today.