In this guide, we’ll compare blockchain ETFs and Bitcoin ETFs. We’ll overview how blockchain ETFs work and look at three prominent examples. Finally, we’ll go over some of the notable limitations of these funds.

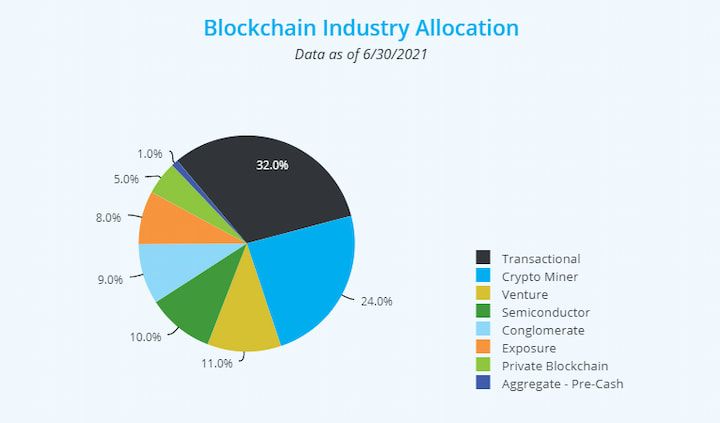

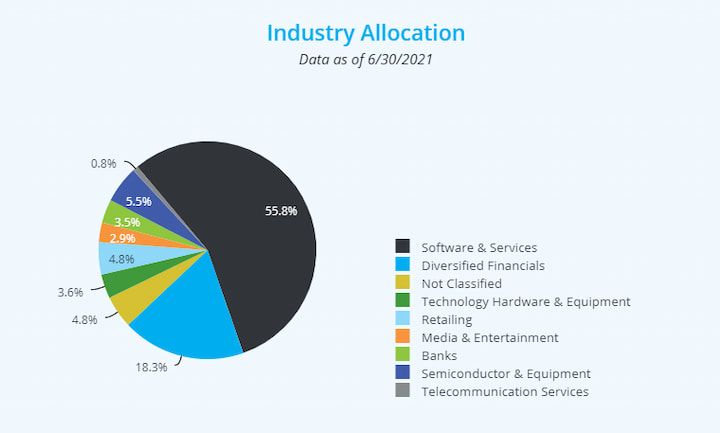

Companies included in blockchain ETFs may focus on banking, fintech, hardware manufacturing, telecommunications, or a wide range of other industries.

Blockchain ETFs, like all other exchange-traded funds, are listed on regulated stock exchanges. These funds focus on companies that have existing blockchain applications or ones that have invested significant time, capital, and/or resources into the research and development of this technology. Blockchain ETFs currently do not offer exposure to virtual currencies such as Bitcoin (BTC).

Blockchain ETFs Vs. Bitcoin ETFs: What’s The Difference?

Exchange-traded funds are becoming increasingly popular in the blockchain industry. While Bitcoin ETFs have faced significant regulatory hurdles, blockchain ETFs have been listed on major stock exchanges since January 2018. So how are they different?

Bitcoin ETF

Unlike blockchain ETFs, Bitcoin ETFs don’t involve buying or selling shares of a company. Instead, they allow investors to gain exposure to Bitcoin (BTC) and/or other cryptocurrencies. Although Bitcoin ETF investors don’t actually purchase crypto directly, each Bitcoin ETF does mirror the value of its asset holdings. It’s crucial to understand that trading Bitcoin (BTC) or cryptocurrencies directly on exchanges is generally considered to be a better option. Still, Bitcoin ETFs do offer a few notable advantages. For example, Bitcoin ETFs are a good option for traditional investors who don’t want to manage their own Bitcoin private key or Bitcoin wallet address.

Very few examples of Bitcoin ETFs exist today; however, there appears to be more support among both regulators and investors for this financial product. In June 2020, Germany’s Deutsche Börse’s XETRA platform announced the launch of BTCE — the world’s first “centrally cleared” Bitcoin ETF. This fund will reportedly be accessible to German, European, and all international accredited investors.

In other countries, similar products have been around for quite some time. Although the Grayscale Bitcoin Trust (GBTC) isn’t technically a Bitcoin ETF, its structure is quite similar. This product launched in June 2013 and has since been followed by other trusts, including ones that include individual cryptocurrencies or a composite of top cryptocurrencies by market cap.

Nonetheless, both Bitcoin ETFs and private trusts are only accessible to accredited investors. In the US, for example, the threshold to become an accredited investor is quite high. An Individual must have a net worth of at least $1,000,000 (excluding the value of one's primary residence) to qualify. Another way to qualify is to have an income of at least $200,000 each year for the last two years (or $300,000 combined income if married) and have the expectation to make the same amount in the current year.

Blockchain ETF

As stated above in the introduction, blockchain ETFs focus on investing in shares of companies that are researching or implementing blockchain technology in some way. Although publicly-traded companies may or may not have their own cryptocurrency (e.g. JPMorgan’s JPMCoin), blockchain ETFs only focus on investing in company shares. As a result, blockchain ETFs are currently considered to be much more regulation-friendly. Retail investors are allowed to buy and sell these funds as they would any other stock that is listed on a public stock exchange.

How Does A Blockchain ETF Work?

Although blockchain ETFs function very much like traditional ETFs, they are still a relatively new financial product with some important distinctions to consider.

Blockchain ETF Trading

Blockchain ETF trading is just the same as any other form of stock trading. Users can access popular blockchain ETFs on stock trading platforms such as E-Trade or Robinhood. The trading hours are determined by the stock exchange that the ETF is listed on. For example, the majority of popular blockchain ETFs are listed on the New York Stock Exchange (NYSE) or the Nasdaq Stock Market (NASDAQ), which both maintain trading hours of Monday through Friday, 9:30 am to 4:00 pm EST. Compared to individual stocks, ETFs usually cost much less per share. However, with the emergence of fractional shares, both are easily accessible to investors.

Which Stocks Are Included?

As with any ETF, the issuing company of a blockchain ETF is responsible for choosing which stocks are included in their funds. Generally speaking, most blockchain ETFs are currently risk-averse. In other words, they mainly consist of blue-chip stocks that you’ve probably heard of before.

One possible benefit of blockchain ETFs is the fact that they appear less likely to be affected by macroeconomic issues that impact a single industry. For example, all companies within an oil and gas ETF are generally affected by issues such as a global decrease in consumer demand. Meanwhile, blockchain ETFs are at least theoretically less affected because they consist of shares from companies in a wide range of industries (e.g. telecommunications, fintech, banking, biotechnology, etc.).

Regional Availability

Most blockchain ETFs are currently listed on US-based stock exchanges. Nonetheless, more blockchain ETFs are becoming available in other regions around the globe.

For example, the Invesco Elwood Global Blockchain UCITS ETF is listed on the London Stock Exchange, Börse Frankfurt, Borsa Italiana, and SIX Swiss Exchange.

In China, the Shenzhen Stock Exchange (SZSE) announced the launch of its Blockchain 50 Index on December 24, 2019. This index seeks to track the performance of the top 50 SZSE-listed companies that are working on blockchain technology. The companies are sorted by market capitalization, and the index is adjusted twice per year (June and December). Prominent companies featured include Ping An Bank, Midea Group, Jilin Zixin Pharmaceutical, among others.

According to the press release, Penghua Fund — a Shenzhen-based asset management firm — simultaneously filed an application to launch China’s first blockchain ETF. If approved by the China Securities Regulatory Commission (CSRC), the proposed ETF would also track the performance of stocks listed on the Shenzhen Stock Exchange (SZSE). As of this writing, Penghua Fund’s blockchain ETF application is still pending.

Popular Blockchain ETFs

Now that we understand some of the basics of blockchain ETFs, let’s look at a few specific examples in more detail. As of this writing, these are three of the largest blockchain ETFs by total assets. Note that stats featured below are relevant as of August 2021. Total assets, largest holdings, expense ratios, and annual dividend yields will likely change over time.

Amplify Transformational Data Sharing ETF (BLOK)

Amplify Transformational Data Sharing ETF (BLOK) launched on January 17, 2018. It’s listed on NYSE Arca and has $1.24 billion in total assets. The three largest holdings of BLOK are MicroStrategy (MSTR), Square (SQ), and Hut 8 Mining (HUT). This ETF’s expense ratio is 0.71% and its annual dividend yield is 1.39%.

Reality Shares Nasdaq NexGen Economy ETF (BLCN)

Reality Shares Nasdaq NexGen Economy ETF (BLCN) launched on January 17, 2018. It’s listed on the NASDAQ and has around $294 million in total assets. The three largest holdings of BLCN are Canaan Creative (CAN), Galaxy Digital Holdings (GLXY), and Baidu (BIDU). This ETF’s expense ratio is 0.68% and its annual dividend yield is 1.26%.

First Trust Indxx Innovative Transaction & Process ETF (LEGR)

First Trust Indxx Innovative Transaction & Process ETF (LEGR) launched on January 24, 2018. It’s listed on the NASDAQ and has over $117.8 million in total assets. The three largest holdings of LEGR are NVIDIA (NVDA), Oracle (ORCL), and Advanced Micro Devices (AMD). This ETF’s expense ratio is 0.65% and its annual dividend yield is 2.53%.

Limitations of Blockchain ETFs

Blockchain ETFs offer a unique way to gain exposure to blockchain technology. While these funds provide a few potential benefits, it’s crucial to understand that there are just as many (if not more) limitations. Here are a few factors to consider before choosing any blockchain ETF.

Dependent On Non-Blockchain Revenue

Because most publicly-traded companies are quite established, they generally have multiple sources of revenue. Blue-chip stocks such as Microsoft (MSFT) or NVIDIA (NVDA) may spend significant capital in researching blockchain technology or developing blockchain-based products. Nonetheless, any revenue or losses incurred from their blockchain technology ventures would only be a small portion of their overall bottom lines. Even though a company might produce innovative blockchain applications, non-blockchain revenue sources will probably play a larger role in determining its stock price.

Extent of Blockchain R&D Unknown

The extent of blockchain research and development at many publicly-traded companies is unknown. Even if a company releases some information to the public, it’s not always obvious how blockchain technology will be applied to create new revenue streams or reduce operating costs. This makes it difficult to determine which company shares should be weighted more or less as a portion of a blockchain ETF’s total assets. This lack of information could even mean that some companies which have high growth potential are excluded from a blockchain ETF.

Limited Number of Available Stocks

While blockchain ETFs typically consist of over 50 publicly-traded companies, the list of possible stocks is still relatively short compared to more established industries. This means that various blockchain ETFs are more likely to contain many of the same stocks, with the main difference being the weight of each holding. Ultimately, because many ETFs are passively managed, stock market investors may be better off creating their own custom portfolios. Some blockchain ETFs are actively managed, which could help adjust to changes in market conditions. The challenge is that keeping up with the ever-changing landscape of various industries and blockchain technology can be difficult even for funds that are actively managed by professionals.

Better Market Options

Because blockchain ETFs have only been around since January 2018, it’s difficult to know whether they will succeed in the long-run. Based on their performance after 3.5 years, there are certainly better market options available for investors. Some individual blue-chip stocks listed within blockchain ETFs increased much more over the same time period.

📧Komodo Newsletter

If you'd like to learn more about blockchain technology and keep up with Komodo's progress, subscribe to our newsletter. Begin your blockchain journey with Komodo today.