Imagine a world teetering on the edge of economic uncertainty, where the quest for a safe haven intensifies. In this scenario, two titans stand tall: Bitcoin and Gold. These assets have sparked endless debates among investors and financial experts, each championing their preferred store of value.

As the global economic landscape shifts, understanding which of these assets offers a better hedge against uncertainty is paramount for anyone looking to preserve their wealth.

Key Takeaways

- Bitcoin and Gold are two of the most debated stores of value in today's financial world.

- Both have unique characteristics that appeal to different types of investors.

- Gold is known for its historical stability, while Bitcoin offers modern advantages like decentralization.

What is a Store of Value?

Definition and Explanation of a Store of Value

A store of value is an asset that maintains its value over time without depreciating. It is an investment vehicle that can be saved, retrieved, and exchanged in the future without its value deteriorating. The primary purpose of a store of value is to ensure that the purchasing power of an asset remains stable or increases over time.

Historical Context and Examples

Historically, assets like gold, silver, and real estate have been considered reliable stores of value. These assets have intrinsic value and are less susceptible to inflation and economic turmoil compared to fiat currencies. Gold, for example, has been used for thousands of years as a medium of exchange and a store of wealth due to its scarcity, durability, and universal acceptance.

Overview of Gold

Key Characteristics and Benefits of Gold

Gold has long been revered for its unique properties. It is a tangible asset with inherent value, recognized worldwide for its beauty and industrial applications. Its key characteristics include:

- Scarcity: Gold is finite and difficult to mine, contributing to its value.

- Durability: Gold does not corrode or tarnish, ensuring it lasts indefinitely.

- Universality: Gold is accepted and valued across cultures and economies.

- Intrinsic Value: Unlike fiat money, gold has intrinsic value due to its physical properties.

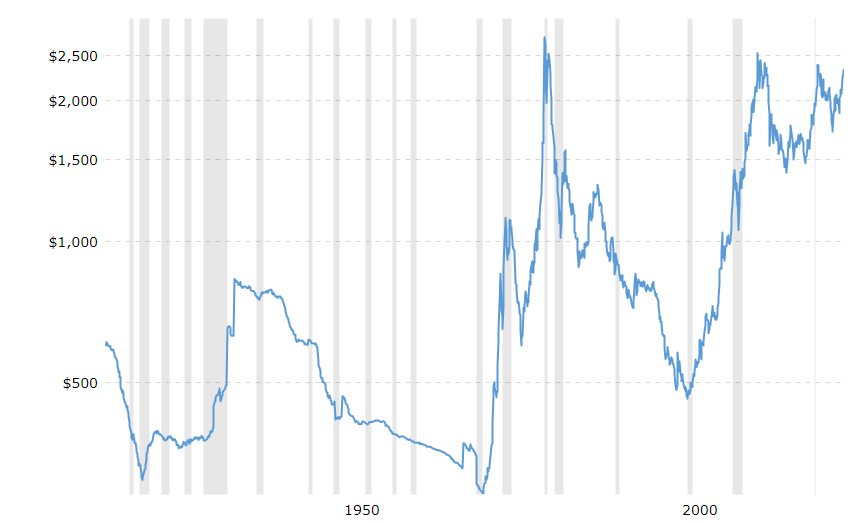

Historical Performance and Stability

Gold has demonstrated remarkable stability and reliability as a store of value. Throughout history, during times of economic uncertainty, wars, and financial crises, gold has retained its value and often appreciated. For instance, during the 2008 financial crisis, gold prices surged as investors sought a safe haven. This historical performance underscores gold's reputation as a stable and reliable store of wealth.

Overview of Bitcoin

Key Characteristics and Benefits of Bitcoin

Bitcoin, a digital cryptocurrency created in 2009, has emerged as a modern contender to traditional stores of value like gold. Its key characteristics include:

- Decentralization: Bitcoin operates on a public blockchain, which is one of four types of blockchain technology. The network is free from government control and interference.

- Scarcity: The total supply of Bitcoin is capped at 21 million coins, making it inherently scarce.

- Portability: Bitcoin can be transferred quickly and easily across the globe.

- Divisibility: Bitcoin can be divided into smaller units, allowing for microtransactions.

- Security: Transactions are secured by blockchain technology, making them nearly impossible to counterfeit.

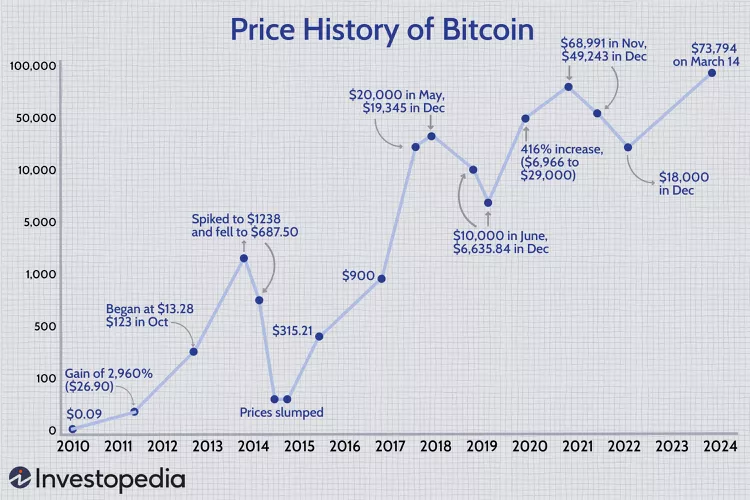

Historical Performance and Stability

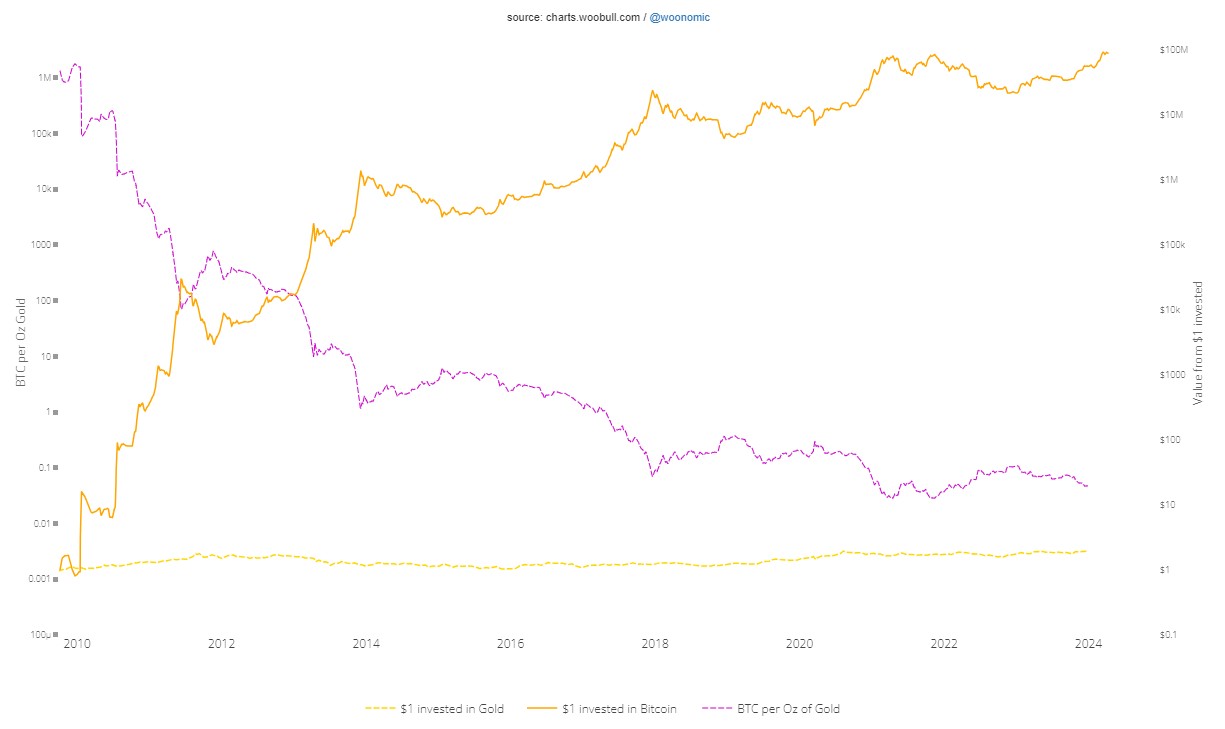

Since its inception, Bitcoin has experienced significant volatility but has also shown tremendous growth. Early adopters have seen substantial returns on their investments. For instance, Bitcoin's price surged from less than a dollar in its early days to over $73,000 at its peak in 2024. Despite its volatility and various Bitcoin hard forks that have created new cryptocurrency spin-offs, Bitcoin's increasing adoption and recognition as "digital gold" have solidified its role as a store of value and shown how Bitcoin is different than other cryptocurrencies.

Bitcoin vs. Gold: Key Comparisons

Scarcity and Supply

Gold's scarcity is a result of its natural occurrence and the difficulty of mining. Bitcoin's scarcity is programmed, with a maximum supply of 21 million coins. While gold's supply can increase with new discoveries and mining technologies, Bitcoin's supply is fixed, making it predictably scarce.

Portability

Gold is a physical asset, making it cumbersome and costly to transport, especially in large quantities. Bitcoin, being digital, can be transferred instantly and securely across the globe, offering superior portability.

Divisibility

Gold can be divided into smaller units, but this process is impractical for everyday transactions. Bitcoin, on the other hand, is highly divisible, down to one hundred millionth of a coin (a satoshi), facilitating microtransactions.

Durability

Gold is physically durable, resistant to corrosion, and can last indefinitely. Bitcoin's durability is digital, relying on the security of blockchain technology. While Bitcoin cannot be physically damaged, its existence depends on the integrity of the digital network.

Liquidity

Gold is highly liquid, with well-established markets worldwide. It can be bought and sold relatively easily, though the process can be cumbersome. Bitcoin also enjoys high liquidity, with numerous exchanges facilitating quick and easy transactions. However, its regulatory environment can impact its liquidity.

Bitcoin ETF vs. Gold ETF

Exchange-Traded Funds (ETFs) offer investors a way to invest in Bitcoin and Gold without directly holding the assets. A Gold ETF tracks the price of gold, providing an easy and liquid way to invest in gold.

Similarly, a Bitcoin ETF tracks Bitcoin's price, allowing investors to gain exposure to Bitcoin without dealing with the complexities of cryptocurrency exchanges.

Recap

In summary, both Bitcoin and Gold have distinct advantages as stores of value. Gold offers a time-tested stability and universal acceptance, while Bitcoin provides modern benefits like decentralization, portability, and digital security.

Understanding these differences is crucial for making informed investment decisions in a rapidly changing economic landscape. Whether you lean towards the ancient allure of gold or the futuristic promise of Bitcoin, each asset offers unique benefits that cater to different investor preferences.

HODL and Trade Crypto with Komodo Wallet

Komodo Wallet is a non-custodial wallet, decentralized exchange, and crypto bridge that supports Bitcoin and stablecoins like PAXG which are pegged to the price of gold. Komodo Wallet also supports Ethereum, Litecoin, Dogecoin, and numerous other cryptocurrencies.