In cryptocurrency trading, security and efficiency are very important. Atomic swaps offer a secure way for users to trade cryptocurrencies directly with each other, without needing intermediaries. This ensures that both sides keep their assets safe.

This article explains how atomic swaps work, the benefits they bring to secure trading, and gives a step-by-step guide on how to implement them.

Atomic Swap Implementation: A Step-by-Step Guide

Implementing atomic swaps can seem daunting, but with the right approach, it becomes a straightforward process. Below is a comprehensive guide to help you get started with atomic swap implementation for secure crypto trading.

Understanding the Prerequisites

Before diving into the technicalities, ensure you have the following prerequisites in place:

- Two Wallets - Both parties need to have wallets that support atomic swaps. Popular wallets like Komodo offer native support for atomic swaps.

- Compatible Cryptocurrencies - You need two cryptocurrencies that are compatible with atomic swaps. This usually means that the coins must share similar hashing algorithms or support cross-chain interoperability. For instance, Bitcoin and Litecoin are commonly used for atomic swaps due to their compatibility with each other.

- Knowledge of HTLC - You should have an understanding of how HTLCs work as they form the basis of atomic swaps. HTLCs ensure that either both parties fulfill the conditions of the swap or the transaction is voided, keeping both parties secure.

Set Up the Blockchain Environment

The first technical step in implementing atomic swaps is setting up the necessary blockchain environment. Here’s how to do it:

- Select the Platforms - Both parties must decide on the blockchain platforms that support atomic swaps. Ensure that the platforms you choose are compatible with the cryptocurrencies you are using.

- Smart Contract Creation - Create the HTLC smart contract. This contract will hold the funds until both parties have fulfilled their obligations (i.e., providing the required cryptographic secrets). Most crypto exchanges that implement atomic cross-chain swaps offer user-friendly interfaces for this step.

Create the Hashed Time-Lock Contract (HTLC)

An HTLC ensures that the funds are locked in place and will only be released if the conditions are met. The process of creating an HTLC can be broken down into the following steps:

- Generate a Secret - Both parties generate a cryptographic secret, also known as a preimage. This secret will be used to unlock the contract.

- Create the Hash - Once both parties have generated the secrets, they create a hash of their secrets. This hash will be shared between both parties, forming the foundation of the contract.

- Lock the Funds - Each party locks their funds into an HTLC on their respective blockchain. This means that the funds are held securely but cannot be accessed until the trade is successfully completed.

Initiate the Atomic Swap

Once the HTLC is set up, the next step is to initiate the atomic swap. This process is typically executed through a decentralized exchange (DEX) or directly from a wallet that supports atomic swaps.

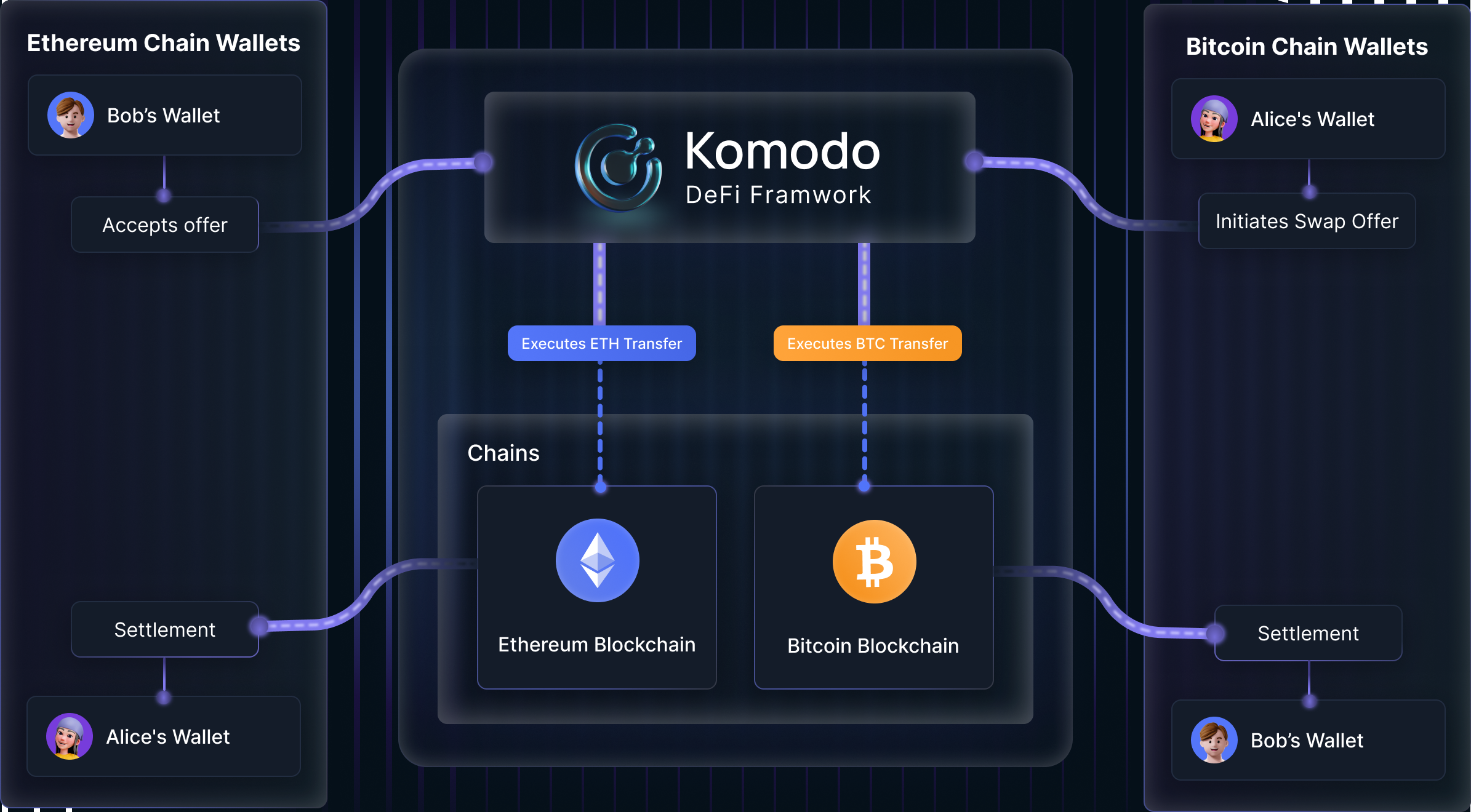

- Exchange Initiation - Party A initiates the swap by committing their cryptocurrency to the HTLC.

- Broadcasting the Transaction - The transaction is broadcast to the network, which ensures that both parties’ assets are locked into the contract until both parties complete the necessary conditions.

The following diagram shows how Komodo’s DeFi Framework facilitates an atomic swap between two blockchains - in this case, Bitcoin and Ethereum. It visualizes the interaction between users’ wallets, the swap execution layer and the settlement on each chain.

Reveal the Secrets and Complete the Swap

Once Party A has locked in their funds, Party B will need to fulfill their side of the agreement. This involves revealing the cryptographic secret, which serves as proof that they have committed to the trade.

- Reveal Secret - Party B reveals their secret to unlock Party A’s funds, and Party A reveals their secret to unlock Party B’s funds. This simultaneous release maintains atomic swaps security.

- Transaction Completion - The swap is completed when both parties confirm the secret and the funds are transferred.

Potential Challenges and Solutions in Atomic Swap Implementation

Atomic swaps offer significant advantages, but traders should consider a few factors to ensure smooth execution:

- Compatibility - Not all cryptocurrencies support atomic swaps. Using platforms like Komodo, which support a wide range of coins, can help ensure the assets you want to trade are compatible.

- Technical Requirements - Implementing atomic swaps can be complex for those unfamiliar with blockchain technology. Leveraging user-friendly wallets and exchanges or collaborating with blockchain developers can simplify the process.

- Transaction Speed - While atomic swaps are generally faster than traditional exchanges, network congestion may occasionally slow transactions. Choosing blockchains optimized for atomic swaps, such as Komodo or Litecoin, can help maintain faster processing times.

Implementing Atomic Swaps for Safer Crypto Trades

Atomic swaps are changing the way cryptocurrencies are traded by allowing direct, peer-to-peer exchanges without middlemen, cutting costs and giving you full control over your funds. Although atomic swaps may seem complex, Komodo Platform offers the tools and support to make the process easy and secure.

With Komodo Platform, you can enjoy safe, and fast cross-chain trading powered by atomic swap technology. Our platform is designed to help traders and users unlock the full potential of decentralized exchanges with confidence.

Take the next step in your crypto journey with Komodo Platform. Learn how to implement atomic swaps using our step-by-step guide and experience the future of secure, efficient trading.

FAQs

How long do atomic swaps take to complete?

The time required to complete an atomic swap depends on several factors, including blockchain network speed and the complexity of the swap itself. Typically, swaps can take anywhere from a few minutes to an hour, depending on transaction confirmations on both blockchains.

Do I need a centralized exchange to facilitate atomic swaps?

No, atomic swaps are designed to work without the need for a centralized exchange. This is one of their key advantages, as they allow peer-to-peer transactions directly between users, cutting out middlemen and offering better security and lower fees.

Can I perform an atomic swap between two different blockchains (e.g., Bitcoin to Ethereum)?

Yes, atomic swaps can be conducted between different blockchains, such as Bitcoin and Ethereum, provided the two networks support atomic swap protocols. This cross-chain functionality is a significant advantage of using atomic swaps, as it allows users to trade coins across different ecosystems securely.