DeFi, short for decentralized finance, is the foundation for a new, open financial system that gives people more control of their finances and reduces dependence on large financial institutions. A few popular categories include cryptocurrency exchanges, lending platforms, wallets, and stablecoins. The DeFi space has only been around since mid-2017 but has already seen serious growth. As of early June 2021, the total amount of virtual currencies locked in DeFi applications is around $50 Billion.

In this article, we’ll talk about what is decentralized finance. We’ll also look at the problems DeFi solves and discuss why it has gained so much momentum in recent years. Finally, we’ll highlight several examples of DeFi applications within the blockchain space.

Key Takeaways

- DeFi is a growing sector - with around $50 billion in total value locked as of June 2021.

- Compared to traditional finance, DeFi is a far more inclusive system since it doesn't require paperwork or formal registration. Funds can be accessed worldwide.

- While DeFi applications have been known to have security vulnerabilities, the sector as a whole is steadily maturing.

- DeFi solves real-world problems and is already playing a major role in many developing nations that don't have adequate banking infrastructure.

What Is DeFi?

DeFi applications foster an open financial system in which ordinary users can lend, borrow, and exchange money using software, rather than a bank.

Whereas the traditional financial sector charges high fees and can be a painful experience, DeFi makes financial services cheaply available with a few clicks of the mouse. Rather than using fiat currencies, DeFi relies upon cryptocurrencies.

Now that we understand exactly what is DeFi and its role in crypto, let's look at the technology required to run DeFi applications. Then, we'll define which applications are considered a part of the DeFi space, and examine potential security challenges.

Foundations of DeFi

Here are some of the foundational technologies that make DeFi possible.

- Blockchain - DeFi applications are built on top of public blockchains or other varieties of distributed ledger technology that support the storage and transfer of virtual currencies. This stands in contrast to traditional financial applications, which use fiat currencies and rely upon a single database controlled by a financial institution.

- Smart Contracts - DeFi applications require smart contracts that execute code automatically when certain conditions are met. After smart contracts are deployed on a public blockchain’s peer-to-peer network, DeFi applications are able to support user activity with little to no need for human intervention. Depending upon the design of the smart contract, a user can lend, borrow, and/or trade virtual currencies on platforms like marketplaces or exchanges.

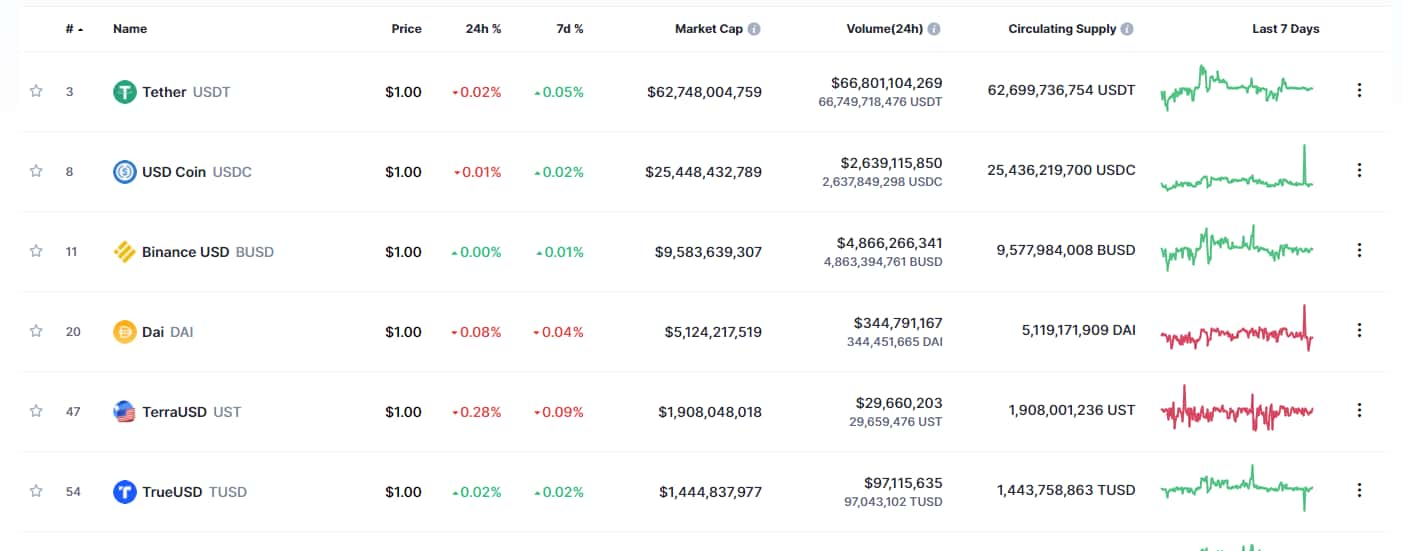

- Stablecoins - Stablecoins are used as a means of representing the value of fiat currencies on decentralized blockchains. DAI, USDT, and USDC are three well-known examples. The value of each of these is supposed to remain pegged at or around $1.00 USD. This lack of volatility makes stablecoins a suitable option for DeFi borrowing and lending platforms. Compared to other crypto assets, lenders typically receive higher APR by lending stablecoins. Borrowers often choose to receive stablecoins to gain access to liquidity because their value doesn’t fluctuate with changes in market conditions.

DeFi and Degrees of Decentralization

The term “decentralized” is used quite frequently within the blockchain industry. It’s important to not let this word confuse you. Let’s take a look at what people really mean when they say that DeFi is decentralized.

DeFi is sometimes referred to as “open finance.” Essentially, we can think of DeFi offering financial services that are more open (user-controlled and available to everyone) than the traditional banking sector, which is composed of financial services that are more closed off (institution-controlled and only available to those deemed eligible).

In other words, we can look at DeFi crypto products in degrees of decentralization, with some applications being more open/user-controlled than others. Rather than a binary, black-and-white scenario, decentralization is best thought of as a spectrum full of various shades of gray. It’s also important to note that just because a financial application is built on a blockchain or uses virtual currencies, doesn’t necessarily mean that it belongs in the DeFi category.

On one end of the spectrum, peer-to-peer lending and borrowing applications like BlockFi, SALT, Celsius, and Nexo are actually closer to traditional financial applications due to their closed nature. Many people actually refer to these as centralized finance (CeFi) applications.

There are several criteria used to make this distinction. All of these applications are custodial, meaning that a single entity— the platforms themselves, in this case— have 100 percent control of user funds. The platform’s team, not the users, make the important operational decisions, such as when to initiate margin calls and provide liquidity for margin calls. The platforms also control price feeds and determine interest rates.

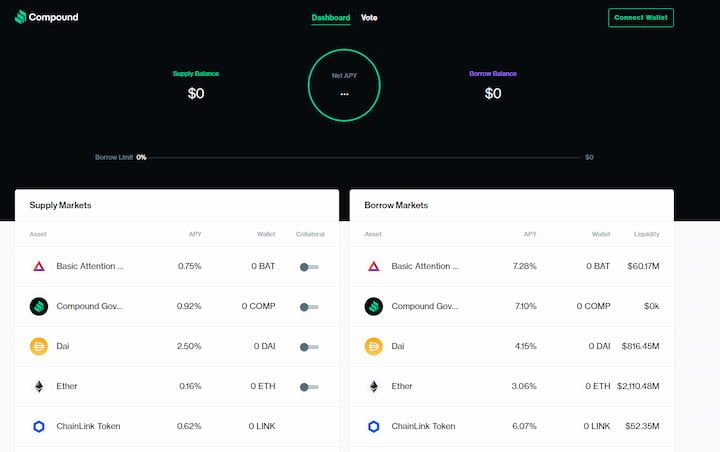

Moving along the spectrum, DeFi applications like MakerDAO and Compound Finance are considered to be more decentralized. However, some aspects tend to be at least somewhat centralized. For instance, in October 2019, a MakerDAO whale controlled 94% of the voting power and used this to decrease the platform’s stability fee by 4%. Likewise, other DeFi applications may be deemed decentralized to a far greater extent but likely have some component that is centralized.

Stablecoins are another example. Although they are categorized as decentralized, it’s reasonable to say they are at least somewhat centralized, due to the fact that their values are often derived from government-issued fiat currencies or commodities, such as gold or silver.

DeFi Challenges

Before looking at several areas where DeFi shines over traditional finance, it’s crucial to understand two of the biggest challenges that end users have to consider.

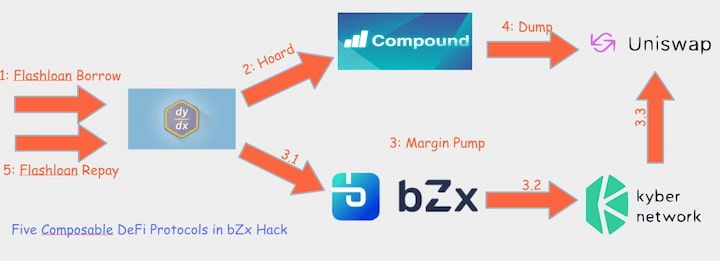

- DeFi Protocol Security - A lot of factors must be considered before determining how secure each DeFi application really is. In February 2020, for example, someone was able to execute two hacks against the bZx protocol using two separate procedures. The first was a sophisticated flash loan hack, which was caused by a bug in the bZx smart contract. The second was a price oracle manipulation attack. These two security breaches resulted in combined ETH losses totaling the equivalent of $954,000.

- Liquidation of Collateralized Loans - Traditional loans are much different than DeFi cryptocurrency loans. DeFi borrowing relies on smart contracts to enforce the rules of collateralized loans. This means that borrowers are required to provide more collateral up front than they are actually borrowing. Many DeFi lending applications have a collateralization ratio minimum of 150% (or a similar percentage). DeFi borrowers also have to be aware of liquidation penalties, which are levied automatically by smart contracts whenever their collateralization ratio dips below the minimum requirements of a particular DeFi platform.

- User Errors and Targeted Hacks - Threats like phishing attacks are quite common in DeFi. Hackers will often claim to be support and ask for a user's seed phrase. Unfortunately, these often lead to theft incidents that are frustrating for end users. Most of the time, there is no recourse that can be taken and funds are gone forever. Remember to always verify the authenticity of the apps you are using and never share your seed phrase with anyone.

- Various User Experience Issues - There are all sorts of additional challenges to consider as an end user. For example, sometimes gas fees can spike suddenly when the blockchain network (e.g. Ethereum) becomes congested. On AMM-based decentralized exchanges, impermanent loss sometimes results in permanent loss of portfolio value. Also, smart contracts sometimes have unknown bugs that cause unforeseen interruptions.

How Does Traditional Finance Compare?

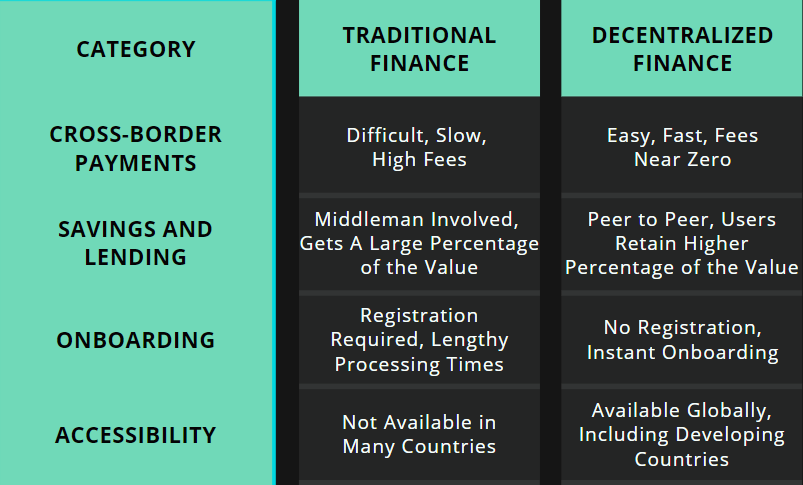

DeFi has emerged as an innovative alternative to traditional finance. Let’s examine a few notable categories to get a better understanding of how they compare today.

Cross-Border Payments

Sending fiat payments from one country to another is expensive with traditional banks and payment processing companies. Using one of the most popular services, converting $10,000 USD to EUR and sending to a European bank account would include a fee of around $80. That’s a transaction fee of 0.8%.

To put this into perspective, a Bitcoin whale was able to transfer $1.1 billion worth of BTC from one wallet to another for only $83, less than 0.00000755% of the transfer.

Savings and Lending

Saving and lending are both costly in the realm of traditional finance. Savings accounts typically provide an annual APR that is well below the inflation rate, which effectively means that the purchasing power of the savings is going down, not up. Over time, savers are steadily losing value on their funds held in ordinary savings accounts.

In the United States, for example, the national average for savings accounts is only 0.09% APR in 2021. Since 1956, there has only been one year in which the US annual inflation sat below that rate. In contrast, most DeFi savings accounts offer greater than 5% APR for at least one USD-backed stablecoin.

As of the time of writing, traditional personal loan interest rates vary from around 5.49 percent to 35.99 percent APR for most providers. Interest rates for loans on DeFi applications vary to a lesser degree but are significantly less in many cases, with most platforms charging less than 10% APR for at least one USD-backed stablecoin.

Onboarding User Experiences

User experience is difficult to quantify, but two potential quantifiable factors to consider are the amount of paperwork and approval waiting times required to access services. While these factors are clear in DeFi, there can be a lot of variables when dealing with traditional finance.

According to a Consult Hyperion whitepaper, the average bank took 32 days to onboard new clients in 2017. Actually being able to access financial services can take significantly longer. Ellie Mae disclosed in an October 2019 report that it takes an average of 47 days to close on a home, which is considered to start with the application filing date and end when funding is received. Personal loans can take up to three weeks with banks and credit unions.

DeFi, on the other hand, requires no lengthy wait times or paperwork. The equivalent of a signup process for using a DeFi platform typically only requires the end user to sign a few messages (verify blockchain transactions) with the private key associated with the wallet they are using. The terms of the agreement are determined and enforced via smart contracts.

Unbanked and Underbanked Populations

As of early 2021, it was reported that there are still 1.6 billion unbanked adults, which means these individuals don't have an account at a financial institution or mobile money provider. This problem isn’t exclusive to developing countries.

A 2019 report by the Federal Reserve showing that 22% of adults in the United States (or 63 million) were underbanked (16%) — having either a checking or savings account, though rarely both. Households are also usually given the underbanked distinction if they've used alternative financing options during the previous year, such as money orders or rent-to-own services. 6% in the US were fully unbanked.

The same FDIC report also asked unbanked survey responders the reasons for not having a bank account. The top two main reasons were “Do not have enough money to keep in account” at 34.0 percent and “Don’t trust banks” at 12.6 percent.

These are problems that DeFi is working to solve. All you need is a cell phone and a data plan to get started. While having a bank account makes it easier to buy virtual currencies on centralized exchanges, blockchains make it simple to receive and store funds without the need for a bank account. Blockchains and DeFi applications generally don’t require users to maintain a minimum balance. They also use distributed ledgers as a technical solution to ensure that virtual currencies don’t require earning the trust of an intermediary, which is the case in traditional finance.

Why Is DeFi Gaining Momentum?

With the above comparison between DeFi and traditional finance, it’s evident that DeFi has several advantages from an end user’s perspective. Still, this doesn’t completely explain why DeFi has maintained such a high growth trajectory. The optimism surrounding DeFi is probably best attributed to the open nature of the space.

Open-Source Platforms

One of the greatest accelerators of DeFi adoption is the availability of open-source software for various smart contract platforms. Instead of having to write and test code for an entirely new blockchain or develop smart contracts from scratch, many blockchain projects provide the development infrastructure and documentation necessary to get started. This directly contrasts with the closed, proprietary software used for most traditional finance platforms. In essence, the DeFi space generally favors collaboration over competition.

New Applications and Use Cases

Most of the capital locked in DeFi today is confined to borrowing and lending platforms, yet there are numerous other use cases emerging. Blockchain-based insurance protocols, prediction markets, and asset management tools already exist. These are just a few examples of some of the more under-utilized DeFi use cases. While these applications may be lacking significant user adoption at the moment, they have the chance to catch up as the DeFi space steadily matures. As blockchain technology continues to evolve, additional applications and use cases will likely emerge.

Increased Accessibility

Another factor for driving the adoption of DeFi is open participation. When thinking about financial sub-sectors like banking, lending, and trading, it’s easy to look at actual market size and current activity as a ceiling. What often isn’t considered is that DeFi could foster more participation and overall market growth due to increased accessibility.

Imagine someone who wants to apply for a loan or insurance coverage. Although these markets are enormous in traditional finance, a range of friction points (e.g. long approval processes, high costs, and complex qualification standards) currently prevent many people from gaining access. If DeFi applications provide a better alternative that eliminates these issues, there is potential to onboard people who aren’t able or willing to participate in traditional finance.

Komodo DeFi Applications

Komodo is a multi-chain platform that enables every third-party business to customize and launch an independent Smart Chain. Every chain can be customized along 18 different parameters, including the option to activate built-in modules like tokens, trustless oracles, micropayment channels, quantum secure digital signature schemes, and much more.

In addition, the Komodo Development Team is working on DeFi applications and open-source infrastructure to support DeFi application development.

For example, with Komodo Wallet, exchanges of digital assets are made directly from one trader to another. In short, this means that you never need to give up control of your funds to make trades. Since all trades can be completed via your personal crypto wallet, there’s no need to make deposits and withdrawals.

Conclusion

DeFi is a quickly evolving sector that expands the potential adoption of blockchain and cryptocurrencies by leaps and bounds. With massive growth achieved in just a couple of years' time and more projects entering the space, it's difficult to say just how big DeFi will become in the future. One thing is for certain - DeFi innovation is here to stay as it begins to challenge traditional finance and provide better opportunities for lending, borrowing, trading, and more to people around the globe.

📧Komodo Newsletter

If you'd like to learn more about blockchain technology and keep up with Komodo's progress, subscribe to our newsletter. Begin your blockchain journey with Komodo today.